Every early-stage startup reaches a point in their journey when fundraising seems the most natural next step to enable future growth. Usually it happens when a company already has the first version of their product as well as some early traction and a specific vision on how to achieve product-market fit.

If you have just developed your minimum viable product, you are probably at one of the early rounds –– Pre-Seed or Seed. There’s not much difference between them. Pre-Seed startups develop project prototypes and test their hypothesis. In turn, Seed-stage companies usually have some level of traction or consumer adoption and want to confirm a Product-Market Fit. Nowadays, the line between these stages is very blurred, so we will use the term (Pre-)Seed Stage in this article.

At the first round, you may not understand how to present your business positively and raise capital from new investors (image by Kamil Halada)

Yet, when reaching this stage, startups often don’t have enough resources to implement their vision, and, specifically, boost their product development. And that’s exactly the point when finding the right funding partner may be game-changing.

If you’re currently at this stage, then this article might be extremely valuable for you since we’ll share our expertise on how to choose the right type of investor for the post-MVP stage, what things about your startup interest them the most, and also give you some fundraising tips!

🤝 Funding Partners for Post-MVP stages

Let’s start by taking a look at the main types of funding sources that are reasonable to approach during the Pre-Seed and Seed rounds.

Startup accelerators

Startup accelerators are often a subgroup of venture capital firms. It may not be the best option if you’re looking for direct funding, or a bigger round as they usually offer limited resources — up to $50k. Instead, they often give «indirect funding» in the form of smart additions: providing coworking spaces, coaching, access to their network of VC firms and enterprises, covering the costs of paid hosting, servers and third-party tools, etc.

Many accelerators also organize pitch days to help you find investors. Sometimes, participating in some accelerator programs (e.g. from Y Combinator or 500 Startups can give you an advantage in the eyes of venture capitalist on your future rounds — if a well-known accelerator chose your startup there must be something worthy in it, right? Yet, it often works only during the very early stages.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/cd96e8be0f6d18c1862f2d5737a77804fe95192e-2784x1778.jpg?w=2784&h=1778&auto=format)

Famous startup accelerators as Y Combinator can provide companies coworking spaces and paid servers for their work (image by Y Combinator Startup School)

In exchange for funding and support, accelerators usually take startup shares. And that’s when you need to think carefully.

Having an accelerator in your (Pre-)Seed round may seriously influence your valuation as accelerators usually take shares for a low price. Imagine that you want to raise $350 thousand for 5% of your startup from a VC (bringing your company at a valuation of $7 million) while you’ve just exchanged another 5% 2 months ago with an accelerator for $25 thousand (at a valuation of «just» $500k). It will be hard to explain to the VCs you’re approaching how you’ve boosted your valuation at 10x in just 2 months, right?

That’s why it’s better to close deals with accelerators as early as possible (if you need them at all), so you don’t bring in a partner at your (Pre-)Seed stage, who will ruin your startup valuation.

Angel investors

Angels are usually high-net-worth individuals who fund startups at the early stages. Unlike venture capitalists, angels may be not so focused on traction — sometimes they may just believe in your idea or your team, come when you don’t even have an MVP, and provide some funds to get you started. Yet, they still want to see that your company is incorporated and doesn’t exist just on paper.

Receiving an initial boost isn’t the only case for collaboration with an Angel. Often startups sign deals with Angel investors while negotiating with VCs about a bigger round. Thus, teams can quickly cover the shortage of resources, which allows them some months of runway, till the round with the venture capital firm is finalized.

When it comes to stocks, Angels often use so-called «convertible loans», which are a great and unbureaucratic way of getting funded. Essentially, it allows startups to receive funding right away in the form of a «loan» that doesn’t immediately convert into the company’s share. Instead, angels receive a 15-25% discount on what the shares will cost during your next funding-round. For example, $30 thousand invested in a company that in the next round hits a valuation of $1.5mln thousand will convert into ~2.4% instead of 2%.

Angels can both support your Startup in terms of resources, domain expertise and contacts (image by Rafal Cyrnek)

Unlike venture capital funds, angels can (но не обязательно/всегда) also be people from the «old economy» that don’t turn investing into their main work or business. They usually have a lot of domain expertise in your niche, they are connected to the market and often understand trends and pains you’re trying to address with your Product.

Thus, when it comes to startup funding, angels want to help and solve some problems in this market, and grow their capitalearn some money doing this. That’s why they usually look for startups from the same industry as theirs so their contribution in the form of experience and contacts can be really valuable.

Sometimes angels may group in syndicates. When you apply to a syndicate, you’ll communicate mainly with lead investors, and they will look for interested members. Usually, it’s easier to get a deal with the syndicate if your project has already been financed by one of the members before and has generated revenue.

Venture Capital Funds

Venture capital funds (VCs) are professional investors who usually work for investment funds and family offices.

Unlike angels who may be driven by an idea, reputation, and industry motives, VCs usually pay attention to a much more practical aspect of funding — return on investment (RoI). That’s why you should consider this type of fundraising only when you already have some traction. For example: a positive cashflow, several pilot clients, a growing number of daily/monthly active users, etc.

Typically growth companies turn to investors when they have first clients or traction (image by Ashley Carre)

Singing the deal with a VC usually takes more time. Apart from the negotiation/screening process itself, when you agree on the company validation, number of stocks and their price, it’ll also take some time to prepare all the legal documentation, sign the documents at the notary, and handle the transaction.

Thus, you may need some extra resources to enable you a runway to live through the process, and that’s when Angels can help. Yet, if your runway allows you not to look for additional funding partners, then it’s better to go straight to VCs.

Crowdfunding

This is a fairly popular funding option, but it’s mostly suitable for hardware Startups. Crowdfunding has a couple of types:

- Donation-based –– people transfer money and don’t expect any reward. One of such crowdfunding sites is GoFundMe.

- Reward-based –– entrepreneurs mainly use this type to fund their startups. In return for the contribution, donors receive rewards, such as early access to your product, a great discount or a free item when it’s released, etc. Kickstarter or Indiegogo are used to raise this type of funding.

With crowdfunding, you can check how potential users will react to your project and what disadvantages they will notice. Backers want to get regular updates on how the project is progressing or what problems you have encountered. But this type of investment has the disadvantage –– anyone can see your app idea and implement it before you do.

💰 What Do Investors Pay the Most Attention to?

Despite fundraising being based on communication, it’s not so spontaneous and unpredictable as it may seem. Even if there’s some room for personal connection, most investors will evaluate your startup based on a few key points.

To help you secure your funding round, we have made a list of top things that investors usually pay attention to.

Traction

Any investor you offer to fund your startup will pay attention to your traction. This is a key point for them to understand that your target audience really needs your product (and your pain-killer solves the pains of your audience).

Traction can be shown in different ways –– there is no universal metric. For example, you can perform week-over-week or month-over-month growth as indicators of usage.

For traction measuring, you can also use:

- Active users number. This statistic will show how often your target audience uses your product and how much progress you’ve made compared to last week or month.

- Revenues and profits. Investors are always interested in these indicators because it’s a sign of a financially well-run business.

Good user growth is more than 10% per month. Projects with such a growth rate have more chances to raise funding. If your product has been growing steadily for 6–8 months, investors will be able to calculate the trend and believe in your development in the future.

Your potential backers probably will pay attention not only to the quantity but also to the quality of your revenue/growth, that can be defined by the following metrics:

Predictability | Profitability | Diversity |

|---|---|---|

Refers to the level of recurring revenue. It can either be tracked based on long-term customer contracts or returning customers. Basically, you should aim for low friction and recurring revenue. | Profitability can be also understood as your profit margin. Depending on the type of your product, the percentage may vary. Yet, within the software industry, most funding partners will look for business models that can generate gross margins of over 60-70%. | Finally, high customer concentration can be recognized as a risk. While early-stage companies often tend to have just a few customers that make up their revenue, VCs usually prefer companies that diversify their revenue base and don’t have customers that make up more than 10-15% of revenues. |

Disengage from friends and family. The investors need to show real profits from the actual target audience, which passed strong customer validation. If you realize that the average check or sales volume has increased dramatically, you can already talk about getting closer to the Product-Market Fit. Subsequently, your costs for attracting a customer will go down, which can be presented as positive numbers for investors.

But it isn’t always about revenue. Millions of pre-revenue startups get their funding and are valued for pilot clients, user base growth, or a signed contract with a large enterprise.

Finally, you’ll have higher chances to close the funding round if you’re able to present a solid go-to-market strategy. To be convincing, your GTM plan should explain how you’re going to reach the product-market fit, show deep target audience understanding, describe competition and demand, and provide a clear vision of distribution channels.

Team

Apart from traction and your product itself, both Angels and VCs pay a lot of attention to your startup team and especially the founding team. And getting «extra points» in the eyes of your potential funding partners isn’t related only to personal chemistry.

In addition to excellent technical skills, your team should have good soft skills (image by Carolina Contreras)

Complementary skill-sets of founders will always look like an advantage. Basically, there are always two key roles in a startup: a technical officer and a sales driver. It’s also possible to create even more effective complementary combinations that can include product lead, marketing expert, etc. At the same time, most investors will tend to avoid single founders and especially ones that have little-to-no tech expertise. In other words, every Steve Jobs needs his Steve Wozniak.

Founder-market fit is another important concept related to this matter. Even though there’s no single formula, VC funds and Angels usually focus on the following aspects of founders:

- Expertise in the chosen industry.

- Healthy «obsession» with the problem you’re solving and your product («don’t start a company unless you can’t help but do it»).

- Leadership skills: ability to recruit, founders synergy, feedback receptivity.

- Long-term vision and execution ability.

- Strong values.

- An unfair competitive advantage (why are you the ones who should solve this problem?).

- A track record of execution (if you already built a company in the past, it’s more likely you’ll succeed again).

Progress

For investors, progress is not always about traction. It’s also interesting for them to invest in a project that shows what progress the team has made over a non-fundraising mode.

Progress is not always about users and sales. Sometimes progress can be defined as hard technical work in a short period of time, often accelerated by collaborating with an MVP software development company, or by working with clients. Small but real successes will be valued higher than fictional traction.

Many funding partners will also pay attention to your future plans and vision. From this perspective, one of the things you may be asked to explain is market readiness (or the «why now?» question). For this, you may need to prove that your team is ready to scale and you have clear investment plans.

Also, VCs and Angels are more likely to support companies that offer painkiller solutions rather than vitamins:

💊 Painkiller | 🍏 Vitamin |

|---|---|

Need to have; difficult to replace or not use | Nice to have; can be replaced or not used at all |

Solves urgent, popular, expensive, frequent and/or mandatory problem | Improves an existing solution |

Introduction to investor before (Pre-)Seed round

Being introduced to the investor before you communicate with him is always a good thing. Investors don’t always want to deal with startups right away (because they get hundreds of them per day). They may not even read your emails sent to their work emails. Accelerator members are a little luckier: they are introduced to a whole group of investors right away. But even they have to expand this list.

Not all intros will be equally effective. The best way is to ask an Angel or VC who has already invested in your project to introduce you to other potential backers. Being introduced by a startup that has already received funding from the same people is the second most effective way.

Another option is exploring various communities, such as AngelList or Hyde Park Angels. They can be both general and specialized. For example, Seed Invest works only with robotic startups, аnd Life Science Angels are interested in healthcare development.

It is better to think of these sites as an additional funding source. We recommend focusing on investors that you know personally. Moreover, it will be easier for you to raise money on these sites if you mention that you have already received some funding from investors.

❓ Most Frequently Asked Investor Question

Before approaching negotiations, brainstorm what questions you might be asked. After that, think of good and complete answers. It’s better to know precisely how you will respond to a similar question.

Make sure you think through all these points before contacting investors:

Market 📊 |

|

Competitors 🏆 |

|

Traction 📱 |

|

Financials 📈 |

|

Team Structure 👥 |

|

Current Financing Round 💰 |

|

📌 Top Tips on How to Raise (Pre-)Seed Funding for Your Startup

When you get serious about finding a funding partner, you’re likely to have some questions. Here we have a couple of tips for you to make your fundraising road cloudless.

Pitch deck creating

It is the first thing investors will see about your company. Here is a good complete structure for your future pitch deck:

- Title slide includes your company’s name, logo, and short information about the work you do. It’s the one section where you can use only 1 slide. Other slides should be organized into groups depending on the section. But don’t use more than 3 slides to illustrate the topic –– this will really lengthen your pitch.

- Executive summary reviews all the information about your business and idea in the shortest brief. When your pitch deck is sent back and forth, C-Level executives don’t get into details. They only look through the executive summary.

- Problem slides focus on a problem that you’re going to solve with your startup.

- Solution section includes your idea of how to fix this problem and its realization.

- With traction slides, share which numbers your PMF demonstrates.

- The market section should answer what your Total Addressable Market is and how large it is.

- In competition slides, describe who your competitors are, what disadvantages they have, and why your startup is more viable than theirs.

- Roadmap slides show your vision of go-to-market or scaling strategy.

- Team slides explain why you are capable of solving the chosen problem and what your unfair competitive advantage is.

- The funds section clarifies how much money you need and how you will use it.

It’s important to make two versions of the start-up deck: a short one that will complement your 10-minute pitching session and an extended one with all the information you wanted to communicate to investors.

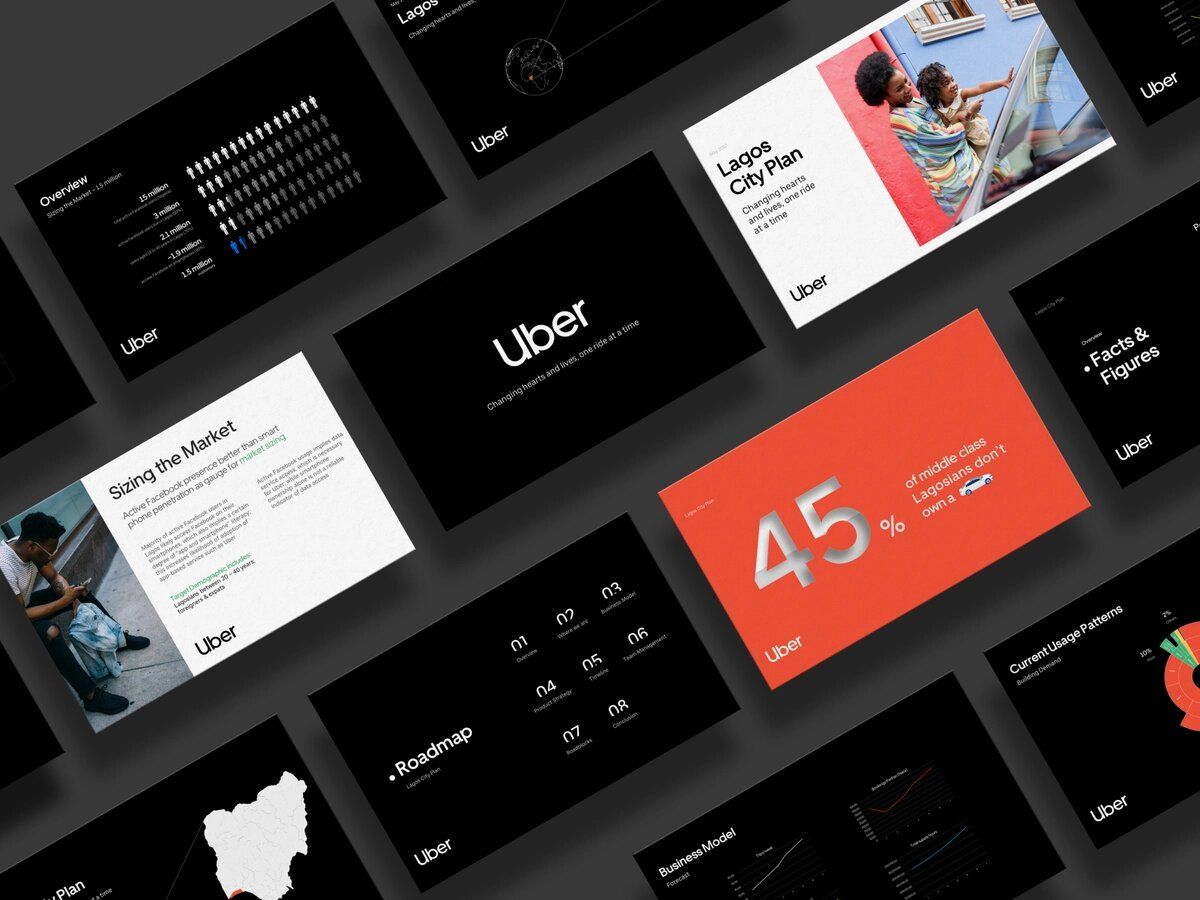

Even Uber needed pitch deck for raising capital to expand Lagos (image by Sanmi Ibitoye)

It’s better to prepare a simple but colorful presentation –– a classic white background won’t make you stand out among hundreds of startups. Same situation with language: use simple sentences but not with several verbs in one.

Slides should be readable –– not all investors have good sight, so take care of:

- Simple font.

- Large size.

- Bold type.

- Contrasting color.

Add charts and diagrams to illustrate your words, but make them legible. Prepare for an explanation of what these data mean.

Don’t raise too much at the early stage

If you’re at the Pre-Seed stage, you have to take as much money as possible without overdoing it. You’ll extend your startup runway, which will help you increase your project valuation and raise more capital at the next round. But if you’re at the Seed stage, you, on the contrary, shouldn’t take too much money.

Before looking for funding partners, think about the approximate amount of money you need. Although it takes great effort to get capital, it is possible to raise too much. This can lead to problems, as well as a lack of money.

Raising too much resources sometimes can be as much of a problem as not raising at all (image by Anastasiia Khazieieva)

One of the difficulties is overvaluation and impossibly high expectations. If you are ranked too high in the early stages like Pre-Seed or Seed, it will be harder for you to increase valuation the next time you raise money. Ideally, it should grow with each new round. If it doesn’t, it is a bad sign for investors. Then the chance of getting funding will decrease.

The second problem is high spending. The more money you get from investors, the more you spend. Usually, the main reason for spending is people. The more capital you have, the more people you attract to your project. But it is more difficult to change direction if you have a big team. High spendings can make it challenging to make a profit, which can be devastating for early-stage startups.

And one of the spending decisions owners often wrestle with is on tech stack: is React Native good to use for a startup , so that you don’t overinvest in native development too early.

The third factor is too high investor expectations. To avoid this, you can underestimate the amount you plan to fundraise. And when you raise that amount of money, you can tell investors that you have decided to get more. Many people do this, and there is no deception, but investors understand that your project is going well.

Either fundraising or project development

The search for investors is very distracting. When founders start looking for capital, all other processes automatically stop. Fundraising becomes the only thing you can think about. A startup suffers from this, as it grows just because of the founders’ actions, especially at the early stage. Therefore, to continue to grow, choose whether you are in fundraising mode or not.

When you do decide to start attracting investors, give it your full attention. Thus, you will quickly complete this process and be able to get back to work on the project itself.

Go talking to investors when you already have something to demonstrate, like Airbnb did (image by Slidebean)

You can take finance from investors out of fundraising mode if they are ready to invest, and you don’t have to pay much attention to them. It takes a lot of effort and time to persuade investors: meetings, preparing materials, and pitching. So, in this case, it is better to postpone negotiations until the next round. If the investor is ready to close the deal on terms that you can easily accept without discussions, you can do it.

If you aren’t in fundraising mode, and the investor is ready to fund you now, but after meeting with donors, it’s best** to decline politely**. Tell him you will get back when you enter a new fundraising round.

Divide your shares accurately

If your startup is successful, you are more likely to make it to the Series A round. To reach it for sure and get new funding, don’t sell many shares at the Seed stage. Otherwise, donors will question whether you have enough shares to keep you motivated to develop your project.

Be sure to manage a cap table and track how many shares you’ve already sold (image by Vladimir Gruev)

The ideal option is to sell no more than 10-15% of the stock at the Pre-Seed stage and up to 20-25% at the Seed. If you get funding from the sale of uncapped convertible notes, you will need to calculate the eventual equity round valuation.

The founders must have a significant stake in the company to have the highest interest in its success.

Convertible loans vs. Equity

Early-stage startup founders may not understand what would be better for their project –– to sell shares or convertible loans. It is better not to dilute stock for a young project so that once when you look at the cap table, you will see you have a minimal share. That is why founders often think about convertible loans. We prepared the pros and cons of these ways of investing and will explain to you the differences between them.

Convertible loans | Equity | |

|---|---|---|

Pros |

|

|

Cons |

|

|

Talk to investors in parallel

As your fundraising activity shouldn’t take much time, you don’t have the chance to talk to investors sequentially. If you talk to several investors in parallel, they tend to make decisions faster, not to miss a good opportunity. When you pitch to multiple investors, information about your company will spread quickly in their communities. So if you present your startup well or poorly, a whole segment of investors will find out about it.

But it would be best if you gave more time to more prospective investors. And you can figure out if it’s worth giving your attention to an investor by calculating an expected value.

Expected Value = Investor Consent Probability × Amount of Resources He's Going to Provide

For example, if you are choosing between:

- a well-known investor who is willing to fund a large sum of money, but after long and arduous negotiations,

- and an angel with a small amount of money, who is easy to persuade,

then their expected value will be the same. If you want to meet investors with a low expected value, it is better to do it after all.

This method will help you protect yourself from investors who delay their verdict. If they start to distance themselves from you, shift your attention to others. Be clear about how interesting you are to the investor, no matter how much you would like to work with them.

💡 Takeaways

Fundraising is not easy, especially for early-stage startups that don’t have so many success stories and supporting donors behind them. It takes a lot of time, and time is a valuable resource. Here is a roadmap that will help you persuade investors to fund your project:

- Gather your data, create a good and simple pitch deck.

- Prepare answers to questions that might be asked by potential funding partners.

- Research investors, define who you’re most interested in, and find ways to reach out.

- Pitch, negotiate, and close the round.

Finding product-market fit is hard. But we’ve supported a lot of our clients before, during and after raising their (Pre)-Seed rounds.

So if you’re looking for a reliable tech-partner, who knows the process inside-out and can boost your Web & Mobile product development after raising your round –– our team will be happy to support you on your journey!

![Stormotion client Max Scheidlock, Product Manager from [object Object]](/static/33294af91c38256bcd5a780ddc41861a/b0e74/max.png)