In today's digital world, where software as a service (SaaS) is becoming more and more popular, building and launching your own SaaS product can be an exciting experience. However, in addition to developing quality software, there is another important aspect that needs to be taken into account - this is the payment infrastructure.

More and more users use digital payments every year. The number of online shoppers is expected to grow steadily by 2025 to reach 2.77 billion people. And digital commerce retail sales are estimated at $6.3 trillion in 2023. It’s projected to exceed $8.1 trillion by 2026.

Therefore, choosing the right payment providers for your SaaS product is a decision that can have a significant impact on the success of your business. The right payment provider can provide smooth and secure payment processing, improve user experience, and even boost sales.

However, there are many payment providers on the market and choosing the right provider for your specific needs and business model can be a daunting task.

In this article, we will review the most popular payment providers for SaaS products and discuss the key criteria to consider when choosing a provider.

Let’s start!

💰 What is Payment Integration for SaaS?

Payment integration for SaaS is the process of integrating payment systems or gateways into your software product, allowing clients to make safe and practical payments for the services they use. It requires integrating the infrastructure of the selected payment provider with the SaaS platform to enable smooth transaction processing and revenue collection.

Customers pay for access to your product or service over a predetermined time, often monthly or yearly, if you run a software business that provides SaaS services. You must choose a method to make these transactions possible if you want to profit from SaaS payments. Setting up your own payment gateway is a possibility, but many businesses choose to collaborate with a third-party payment processor that manages credit card payments on their behalf.

Simple: clients make an online purchase, pay you, and your selected SaaS payment system processes the payment, taking care of everything from billing their credit card to sending the cash to your bank account.

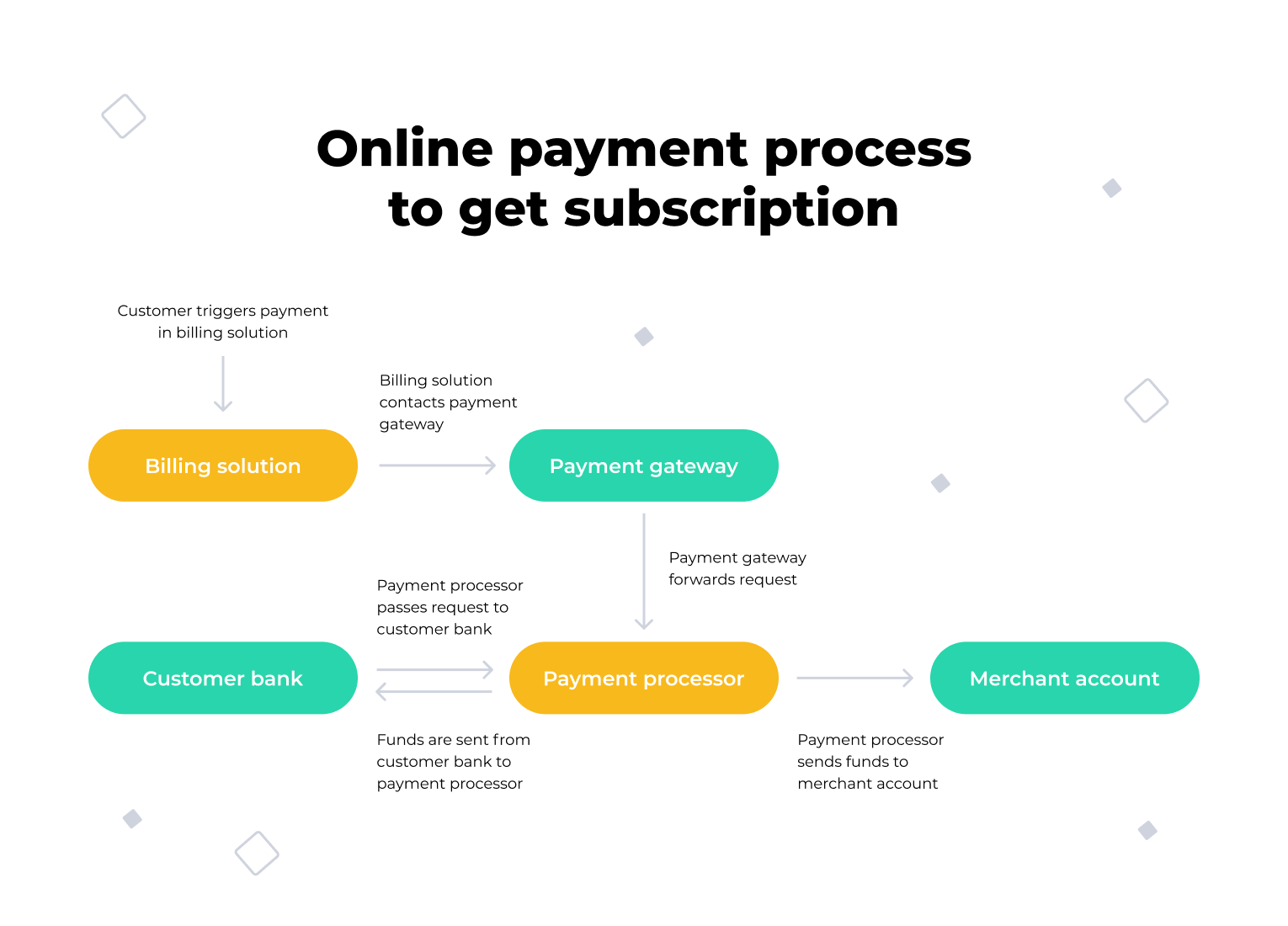

To subscribe to your SaaS product, the client and his data go through three main stages:

- The customer chooses a plan and a payment method;

- Collecting payment information to make a payment;

- Maintaining a subscription in order to charge a fee every month.

Schematic representation of how the online payment process to get a subscription takes place.

(image by Stormotion)

Each of these stages is a separate system. Let's look at them in more detail.

1. Payment Gateway

Your clients may transmit their payment information securely using a payment gateway. The payment gateway notifies the customer's bank that "this is how much we need to charge" when they submit their credit card and billing information.

For example, payment gateways are PayPal and Stripe. We will talk about them in more detail below in the article. Continue reading!

2. Merchant Account

Businesses may accept and process credit card payments using a merchant account, a special type of bank account. Before being transferred to the merchant's bank account, the money from a customer's purchase is first put into the merchant account. Establishing merchant accounts with acquiring banks or payment processors is routine.

3. Subscription Management

This is the process of managing recurring payments and subscriptions for SaaS products. This includes dealing with subscriber registrations, renewals, upgrades, downgrades, cancellations, and billing cycles.

This is where Recurly can help you - this is an example of a subscription management tool for SaaS.

⚖️ Payment Gateway vs Payment Processor

There are two key players responsible for making your customer's online payment smooth and secure: the payment gateway and the payment processor. Some people think that these two terms are essentially the same, but they are not. They are individual components of the payment ecosystem. Let's figure it out!

From the previous section, you already have some knowledge about the payment gateway. It acts as a virtual bridge between the buyer, seller and financial institution. Its main function is to securely transmit payment information during an online transaction.

For example, when a customer makes a purchase on a website or app, the payment gateway encrypts and securely transmits sensitive payment data, such as credit card information, to the payment processor.

Understanding the roles and functionalities of payment gateways and payment processors will help you make informed decisions when selecting the right payment service providers for your business.

(image by Dhimas Mo)

While the payment processor deals with the actual processing and settlement of the payment transaction. Once the payment gateway securely transmits the payment information, the payment processor takes over. It contacts various payment networks such as credit card networks or alternative payment methods to verify and process the transaction.

The payment processor also checks for funds, performs fraud checks, and coordinates with the relevant financial institutions involved in the transaction.

Together, these two organizations form the foundation of a strong payment infrastructure that enables companies to accept a variety of payment options and offers clients a simple, safe payment process.

🤔 How to Choose a SaaS Payment Gateway?

In this section, we want to consider the main criteria for choosing the right payment gateway for your SaaS products.

Security & Compliance 🔒

Make sure that the payment provider has a valid PCI DSS compliance certificate, and acquaint yourself with their security procedures and resources before selecting them.

When it comes to online payments, employing payment providers increases the danger of fraud and data leakage. Choose SaaS payment solutions that adhere to the strictest data security regulations, such as the Payment Card Security Standard (PCI DSS), in order to secure the sensitive data of your clients.

Learning how to create a kiosk application also involves prioritizing PCI DSS compliance to safeguard user data in public kiosk settings.

Payment Options Available 🌐

Payment methods should be as diverse and convenient as possible for your client. Therefore, it’s important to choose a payment gateway that supports a wide range of payment methods, including major credit and debit cards, popular digital wallets such as PayPal, Apple Pay or Google Pay.

The more options you integrate into your website, the more likely customers are to sign up.

Fees & Recurring Payments 💸

The payment gateway charges a fee for the payment transaction. Find out in advance how much this fee is on different payment gateways, compare different options and consider the expected volume of transactions to make sure the prices fit your budget.

Recurring billing refers to the process of regularly charging customers for payments on a predetermined schedule. This payment scenario doesn’t require the direct participation of the payer and the re-entry of payment data. Being set up once, recurring payments are made automatically, without the obligatory confirmation from the payer.

Each digital company that provides payment gateway services or tools to process and authorize transactions for consumers and businesses has its fees.

(image by Vishnu Prasad)

It’s on the basis of regular payments that most SaaS companies operate. By giving your customers the opportunity to activate recurrent billing, you save them from being left without your service at the most inopportune moment. Moreover, you protect your business from losing customers.

Transaction Limits 🔐

Gateway providers set limits on the amount of transactions. Make sure they meet your business requirements and provide the flexibility to grow and increase transaction volumes without facing caps or penalties. Also, be sure to pay attention to whether there are daily and monthly transaction limits that are suitable for you.

Subscription Management Tools 💼

Choosing a money collecting system is crucial for SaaS product owners. Verify whether your payment service supplier has subscription analytics software and administration options. It will assist you in monitoring and managing every aspect of revenue delivery and subscription management.

Additionally, it offers a wonderful subscription experience for customers. Make sure customers can pick how and when to pay with ease.

Reporting and Analytics 📈

Comprehensive reporting and analytics capabilities should be offered by an established payment gateway. To improve your payment procedures and decide on your course of action for your business, look for tools that let you track important metrics, evaluate transaction data, keep an eye on revenue, and gather insights.

Physical Goods vs Non-Physical Goods 📱

Think about if the payment gateway is appropriate for the sort of goods you are selling. For processing payments connected to physical commodities, digital products, or services, some payment gateways may have limitations or extra requirements. Make sure your company strategy is flawlessly supported by the gateway you choose.

Check if the payment gateway supports Apple Pay, which enables consumers to make safe payments using their Apple devices, for instance, if you are targeting Apple users. Apple Pay integration can improve the checkout process for iOS customers.

💳 Stripe

Stripe, a major financial services provider, was established in 2010. It has a wide range of capabilities and is made for online shopping. Amazon, Google, Lyft, Pinterest, and Slack are a few of its customers. For these businesses, Stripe can manage huge transaction volumes. The finest platform for payment technologies for developers is Stripe. Web developers may include payment processing into their websites and mobile apps using its APIs.

Pros

- Supports a wide range of payment methods, including major credit and debit cards, digital wallets, and alternative payment methods.

- Provides a user-friendly interface and easy integration with various platforms and programming languages.

- Offers advanced features like recurring billing, subscription management, and customizable checkout.

- Provides robust security measures and PCI compliance to protect customer data.

- Transparent pricing structure with competitive rates and no setup or monthly fees.

Cons

- Limited customer support options, primarily through online documentation and community forums.

- Some users may find the learning curve steep due to the advanced features and customization options.

- Certain industry sectors, such as high-risk businesses, may face stricter scrutiny during the onboarding process.

Integration

Stripe offers integration possibilities for numerous platforms and development environments. Because of that, it should be quite easy for your development team to integrate Stripe into your Android, iOS, Web, or React Native apps. Here, we've gathered some of the relevant links for you:

- Android: Stripe Android SDK

- iOS: Stripe iOS SDK

- Web: Stripe JS

- React Native: Stripe React Native SDK

Developers may implement secure and practical payment methods for their users thanks to the features and tools provided by each SDK or library, which are specifically suited to each platform.

Cost

The cost of transactions for credit and debit cards, as well as for online wallets - is 2.9% plus 30 cents per transaction.

Platform safely accepts big payments or regular payments by wire transfers, automated clearing house debit, or ACH credit. For ACH direct debit transactions, Stripe charges 0.8%.

💳 Braintree

A software-as-a-service (SaaS) payment gateway called Braintree enables companies to accept online payments from clients. It was started in 2007, and PayPal bought it in 2013. The two primary products offered by Braintree are Braintree Direct (for accepting payments online) and Braintree Extend (for connecting with partners).

Additionally, there is Braintree Auth, which is still in development as of this writing but will "enable your merchants to connect a Braintree account to your platform, and receive permission to take action on their behalf." There is also Braintree Marketplace, which handles payments for online marketplaces.

Pros

- Supports major credit and debit cards, digital wallets (including PayPal), and other popular payment methods.

- Offers a simple and intuitive integration process, with SDKs available for multiple platforms.

- Provides comprehensive fraud protection and advanced security features.

- Offers recurring billing and subscription management functionality.

- Has a dedicated support team available for assistance.

Cons

- Pricing structure may be less transparent compared to other providers, with additional fees for certain features and services.

- Some users may find the setup and configuration process complex.

- Limited customization options for checkout pages compared to other providers.

Integration

As with Stripe, your development team will be able to integrate Braintree into Android, iOS, web, or React Native app. We leave links for you!

- Android: Braintree Android SDK

- iOS: Braintree iOS SDK

- Web: Braintree JS SDK

- React Native: react-native-braintree

Cost

The cost of transactions for credit and debit cards, as well as for online wallets - is 2.59% plus 49 cents per transaction. For ACH payments Braintree charges 0.75%.

💳 PayPal

PayPal is a SaaS payment gateway that enables both private users and commercial entities to send and receive payments online safely. Its main office is in California, USA, where it was established in 1998.

PayPal is well-known as a redirect/hosted payment gateway. It accepts payments from PayPal as well as all of the major credit and debit cards through its gateway. Has several services, including:

- PayPal Payments Pro if you require an integrated checkout straight on your website.

- PayPal Express Checkout adds a PayPal button to your website.

- Gateway Payflow. Payflow Pro offers extra checkout customization tools with a monthly subscription, and Payflow Link assists you in creating a free checkout page hosted by PayPal. Customers may use their credit cards to make both types of payments without ever leaving your website.

- The pricing structure is extensive. It involves a number of computations related to micropayments as well as the use of their platform.

Pros

- Widely recognized and trusted payment brand with a large user base.

- Supports major credit and debit cards, PayPal accounts, and international payment methods.

- Offers an easy and familiar checkout experience for users.

- Provides strong buyer and seller protection policies.

- Offers different pricing plans to cater to various business needs.

Cons

- May have higher transaction fees compared to other providers, especially for international transactions.

- Limited customization options for checkout pages.

- Some users may experience delays in fund transfers to their bank accounts.

- Requires a separate PayPal account for customers to complete transactions.

Integration

For mobile platforms, PayPal doesn’t have platform-specific SDKs. But you can use Braintree. Here and here you will find more information about it. For web apps you can integrate PayPal JavaScript SDK.

Cost

The standard rate for receiving transactions varies by region and transaction type. On average, this is from 3.40% to 5.40% plus a fixed fee. You can find all other information on the company's official website in the PayPal Merchant Fees section.

💳 Mangopay

MangoPay is a payment provider specialized in providing payment and financial management solutions for platforms, online marketplaces and crowdfunding platforms.

It provides resources for managing accounts, processing payments, making payouts, and conducting other financial activities. Along with enforcing regulatory compliance, MangoPay provides fraud prevention and implements KYC (Know Your Customer) and AML (Anti-Money Laundering).

Pros

- Supports a wide range of payment methods, including major credit and debit cards, digital wallets, and bank transfers.

- Provides a user-friendly interface for managing transactions and accounts.

- Offers multi-currency capabilities for international transactions.

- Provides secure and compliant payment processing, including strong fraud prevention measures.

- Offers flexible pricing plans based on transaction volume.

Cons

- Requires a separate application and approval process for accessing the Mangopay platform.

- May have limited availability in certain countries.

- Some users may find the documentation and support resources less comprehensive compared to other providers.

- Additional fees may apply for certain features and services.

Integration

Mangopay provides integration with various platforms, including Android, iOS and web applications. But support for these platforms may be somewhat limited or less active than other providers.

Cost

The cost of Mangopay services depends on the specific needs and requirements of your business. The cost of transactions for card is 1.4% + €0.25. More information you can find on the official website.

💳 Sofort

Online payment service Sofort, often known as Sofortüberweisung, is provided by Klarna. With the help of Sofort, customers may make payments instantly from their bank accounts. It offers a high level of security and data protection, and it operates in real time. In Europe, Sofort is quite popular and accepts payments in many different currencies.

Pros

- Supports bank transfers as a payment method, allowing customers to make payments directly from their bank accounts.

- Offers a simple and secure checkout process.

- Widely accepted in European countries, especially Germany, Austria, and Switzerland.

- Provides real-time confirmation of payment to merchants.

- Offers competitive pricing with transparent transaction fees.

Cons

- Limited support for credit and debit cards and other alternative payment methods.

- Availability may be limited to specific countries or regions.

- Some users may find the setup and integration process less straightforward compared to other providers.

- May have less extensive customer support options compared to larger payment providers.

Integration

Klarna doesn’t provide specific SDKs. Sofort integration with web applications or platforms can be done through the use of APIs.

Cost

Successful transactions made via Sofort cost just €0.11 + from 1% to 2%.

🧐 Comparison Of Popular Payment Gateway Providers for SaaS

Well, there was a lot of different information in today's article. Therefore, we decided to collect it in tables. This will make it easier for you to compare payment providers. We hope this will make your choice easier!

Let's start with the cost and fees of payment providers 👇

Providers | Monthly Fee | Fee Per Transaction | Setup Fee | Chargeback Fee |

|---|---|---|---|---|

Stripe | 0 | 2.9%+$0.30 ACH/Bitcoin processing 0.8% | 0 | $15 |

Braintree | 0 | 2.9%+$0.30 | 0 | $15 |

PayPal | $30 only for Payments Pro | 3.40% - 5.40% + a fixed fee | 0 | $20 |

Mangopay | €49 | 1.4% + €0.25 | 0 | €15 |

Sofort | 0 | €0.11 + from 1% to 2%. | 0 | €15 |

And here is a table with other features for comparison 👇

Providers | Payment Methods | Gateway Features | Credit/Debit Card | Countries | Currencies |

|---|---|---|---|---|---|

Stripe | AliPay, Android Pay, Apple Pay, Bitcoin, ACH, WeChat, EPS | PCI DSS compliance, AVS, SSL, CCV, Virtual Terminal | Visa, MasterCard, American Express, Discover, AMEX | 47 | 135+ |

Braintree | PayPal, Venmo (in the US), Apple Pay, Google Pay, ACH | PCI DSS compliance, AVS, SSL, CCV | Visa, MasterCard, American Express, Discover, JCB | 45 | 130+ |

PayPal | Credit/debit cards, checks PayPal, PayPal Credit, Venmo, Android Pay, Apple Pay, Bitcoin | PCI DSS compliance; SAS 70, SDP certification; AVS, SSL, CCV, Virtual Terminal | Visa, MasterCard, American Express, Discover, JCB, Diners Club, AMEX | 297+ | 25 |

Mangopay | Credit/debit cards, Google Pay, Apple Pay, Sepa, Diners Club | PCI DSS Level 1, PSD2 SCA Compliant, E-Money License in EU/EEA | Visa, Maestro, American Express | 120+ | 14 |

Sofort | Credit/debit cards, Google Pay, Apple Pay, PayPal, Click to Pay, Cofidis, Bizum, Giropay, Trustly, Bancontact, iDEAL, Multibanco, SEPA Direct Debit, SEPA Request-to-Pay, Klarna | SSL, PCI DSS compliance | Visa, Mastercard, American Express, Discover, Diners Club, JCB | 13 | 10+ |

🧑💻 How to integrate a Payment Gateway

In this section, we will delve into the process of integrating the payment gateway in more detail. Let's look at integration using the example of one of the largest payment gateways - Stripe.

The Stripe integration tutorial lists seven platforms, but those are only the ones for which there is an official integration. In theory, you can write in any language and platform. Let's look at an example for Node.js.

First, you need to install the official SDK.

If using npm:

or for yarn:

Next, you need to initialize the SDK and create a simple server using Express. To do this, use the secret key from your personal account. make sure that secret key isn’t exposed to the client side and isn’t sent with any requests.

This code sets up an Express server that listens for requests on /create-payment-intent endpoint and creates a PaymentIntent, which is then used to confirm payments.

Next, you need to set up the library on the client-side. Stripe offers various libraries for different platforms and frameworks, but in this example, we will use a React.js client.

First, you need to install the necessary libraries on your existing React project.

For npm:

Or for yarn:

After that, you need to update the index.js file and wrap all child elements in Elements. It's important to note that Stripe is initialized here with the public key, which, like the private key, can be found in your account dashboard.

Now we can create a component that collects payment information, makes a request to the server to retrieve the clientSecret from the newly created PaymentIntent, and completes the transaction.

It is crucial to use the elements provided by the official library for capturing user card information and other details. These elements are specifically designed to securely transmit user data to Stripe's servers. Improper handling or storage of payment information is legally punishable, so it is better to entrust this responsibility to Stripe.

We hope our mini-guide was helpful. If you have any questions about the integration of the payment gateway - we are always happy to help you! At the end of the article, we left a feedback form. Contact us!

📚Case Study

We also want to share with you our experience in integrating payment providers into various applications.

MangoPay was selected as the payment processor for the OvalMoney MVP development in 2016. The architecture of MangoPay made it possible to set up rules for money transfers to users' wallets inside the application and to create user accounts. In-App Purchases were also handled by Stripe, providing users with a streamlined payment process.

The Purchasely platform was incorporated for the Clay app to implement unique Payment Gateways inside the iOS app. This made it possible for marketers to do A/B testing on various discounts, promotions, and payment channels. In-App Purchases were made concurrently using Stripe, which offered a dependable payment method.

Stripe was selected as the payment provider for both the ForceUSA and Art of Comms applications. It was utilized to grant users access to premium content and offer membership services. Stripe's robust features and flexibility ensured a secure and seamless payment experience for users.

Braintree has been selected as the payment service provider for the Feel Amazing app. To make access to premium content easier and provide consumers with subscription alternatives, Braintree was integrated into the app, which has made the payment procedure dependable and easy.

👂 Takeaways

Choosing the right payment provider for your SaaS product is an important decision that can make a big difference in the success of your business. With the growing popularity of digital payments and the rise of online shoppers, it’s essential to have a reliable and efficient payment infrastructure. Let's summarize:

- When choosing a payment provider, prioritize security and compliance with industry standards such as PCI DSS.

- Choose a payment provider with a wide range of payment methods.

- Learn in advance about ways to integrate the payment provider into the platform of your application.

We hope you found this article helpful and make choosing the best payment provider a lot easier.

If you have any questions about how to integrate a payment provider or others, we will be happy to help and cooperate with you! Contact us and we will arrange a meeting.

![Stormotion client Pietro Saccomani, Founder from [object Object]](/static/40e913b6c17071a400d1a1c693a17319/b0e74/pietro.png)