Payment system integration may seem like a real challenge. Especially for the ones who have never done it before. But since we’re going to talk about payments and money, let’s start with some numbers!

Here are a few stats so you see how mobile commerce is booming right now:

- More than 50% of all internet shopping traffic comes from mobile devices.

- 4 out of 5 smartphone users (79%) have made an online purchase using their mobile devices at least once in 6 months.

- Events as Black Friday or Cyber Monday are also not immune to mobile fever with up to 40% of sales made via smartphones.

These numbers (by OuterBox) prove that we’ve witnessed a turning point in the eCommerce sphere. No matter whether you sell goods or services your customers expect to make in-app purchases. In this article, we’ll tell you how to integrate a payment gateway in a mobile app so as to make it possible.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/5878d6828a3c3f6d956b2f971a617f7dc38b220a-700x525.png?w=700&h=525&auto=format)

Payment gateways are must-have parts of many mobile apps (image by Umar Aji Pratama)

But let’s start our journey to the world of money transactions and credit cards with revising everything we should know about a mobile app payment gateway technology.

💸 Payment Gateway for a Mobile App: What Is It and How Does It Work?

The Payment Gateway is the technology you need to keep your mobile business running. We all know this workflow very well:

- A user opens an app and chooses products or services that he’d like to buy.

- His order goes into a shopping cart.

- He checks out and pays by credit/debit card.

- This data is transferred to the bank that issued the card to our user.

- The bank checks whether this person has enough money on his account and doesn’t have any limits or restrictions.

- If yes, the request is verified, the user is charged and you (as a merchant) will soon receive his money. If no, the request is just rejected.

Here’s how it looks:

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/66881fd6a0aba6d36769f885348ebddc963a5dbf-700x317.png?w=700&h=317&auto=format)

A visual explanation of how payment gateways work (image by Square)

To put a payment gateway for a mobile app into effect your development team will have to integrate a special SDK - a Software Development Kit.

For non-developers out there: the SDK is a wrapper around other services’ APIs, so developers can build their own functionality. It’s basically a special program/set of tools that lets your application interact with such services. In our case, banks play the role of those “other services”.

So when you’ll need to process a transaction, your application will use the SDK to tell the mobile payment provider “I need to charge a card with token N (a token is a unique number that is tied to each card in your app) and transaction amount $X”. And then the data will be processed without your direct interference.

You can see how everything works in this video:

In the context of kiosk application development, the choice of payment gateway is crucial to providing a smooth, self-service transaction experience for users in retail, hospitality, and other sectors.

To integrate a payment gateway in a mobile app, your developers have to take a few steps:

- Go to the website of the chosen mobile app payment gateway, to the Documentation section (we’ll share links closer to the end of this article so keep reading).

- Find and reuse right code samples for your application.

- Adjust them for your case.

- Great, now it should work!

However, there are a few more things that require your attention. I mean merchant accounts and PCI-DSS compliance.

Merchant Accounts

One more thing that requires our attention is merchant accounts that receive customers’ mobile app payments. The merchant account can fit into one of these two categories:

- Dedicated merchant account

- Aggregate merchant account

A dedicated account is the personal internet-based bank account that was set up intentionally for your business.

Pros of using a dedicated account

- You have full management over your account.

- It provides you with fast transfers - usually within 3 days.

- You can negotiate tailored rates for your business’s sales.

Cons of using a dedicated account

- Harder to get approved.

- Takes more time to get approved.

- Set up fees are higher.

However, the most popular mobile payment gateways offer you aggregate merchant accounts. This is a collection of different accounts grouped together. So when you receive your money, it gets dropped in a pool with many other companies.

Pros of using an aggregate account

- They are easy to set up and supported by all the best mobile app payment gateways.

- It takes fewer data and efforts to set up such an account.

Cons of using an aggregate account

- Limited management over your account.

- Fixed fees that can’t be negotiated.

- Money transfers may take from 2 days to a week.

PCI-DSS Compliance

Another thing you need to work with customer banking data is security standards compliance.

The certificate we’re talking about is also known as PCI-DSS - the Payment Card Industry Data Security Standard. Yet, there is some good news for you.

The PCI-DSS certification may take months (and thousands of $) but only in case you store customers’ banking data and handling mobile app payment processing on your own servers.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/d86f512b43214e0b69fdda719abb3b7c7d6a3eb4-700x525.jpg?w=700&h=525&auto=format)

PCI-DSS complaince proves that you customers' data is safe and sound (image by Matt Anderson)

But the payment gateways which we talk about in our article help you to avoid the headache, as they handle the PCI-DSS compliance on their end. Services like Stripe or Braintree encrypt sensitive data on their servers and send it to you as a token, so it doesn’t stay on your servers.

Since we have just mentioned some of the best mobile app payment gateways let’s take a closer look at them.

💳 Top 8 Popular Mobile Payment Gateways

In this article, we decided to focus on 8 payment gateways that in our opinion are the best options to choose from. These are:

- Braintree

- Stripe

- Mangopay

- Authorize.net

- BlueSnap

- PayU

- SecurionPay

- Worldpay

Let’s find the best option for your case!

Braintree

Launched in 2010 (and bought by PayPal in 2013), Braintree managed to become one of the best mobile app payment gateways. It’s even enough to look at its current customers: Uber, OpenTable, StubHub, Skyscanner, and many others. Why do they prefer this service? Here are the reasons.

Gateway Details 🏦

- It works with many payment methods

Braintree accepts payments from:

- Cards - Visa, Mastercard, American Express, Discover, JCB, Diners, Maestro, UnionPay

- Digital Wallets - PayPal, Venmo, Apple/Google/Samsung Pay, Visa Checkout, Masterpass or AMEX Express Checkout

- Local Payment Services - like ACH in the US, Giropay in Germany or iDEAL in the Netherlands

-

Accepts 130 currencies (including Bitcoin!).

-

Braintree introduces a new security layer that’s also known as 3D Secure 2.0. This is a frictionless authentication solution which protects users and your business against fraudulent transactions.

-

Payouts take place within 2 days.

-

Extra functionality includes recurrent billing, easy data migration, full PCI compliance, in-store payments, and wide reporting possibilities.

Pricing Details 💵

Braintree doesn’t have any hidden fees. You don’t pay for setup and any monthly fees, moreover, you don’t pay any rates for the first $50,000 processed.

Then the standard rate of 2.9% + $0.30 per transaction is applied.

BUT

- For transactions in any non-USD currency, an extra 1% fee applies.

- If the customer’s card was issued outside of the US, Braintree also charges an extra 1% fee.

- For each chargeback, a flat $15 fee is assessed.

More pricing details can be found here.

Development Details ⚙️

Braintree’s documentation is great so your dev team will be probably happy to work with it.

Client SDKs are available for iOS, Android and Web (JavaScript) platforms.

Server SDKs support PHP, Python, Ruby, .NET, Node.js and Java.

The provider also offers ready-made payment UI but leaves your team an option to create a custom checkout form.

All documentation can be found here:

iOS | Android | JavaScript

Stripe

Stripe is a direct Braintree’s competitor and another great mobile app payment gateway. What we do like about Stripe is that it’s truly user- and developer-friendly in many ways. Let’s dive in!

Gateway Details 🏦

- Just like Braintree, Stripe supports a lot of different payment methods. Yet, they aren’t absolutely similar (for example, Stripe doesn’t work with PayPal, so check the table below carefully)

💳Cards | Mastercard, Visa, American Express, JCB, Discover, Diners and UnionPay |

👛Wallets | AmEx Express Checkout, Alipay, Apple/Google/Microsoft Pay, Visa Checkout, Masterpass & WeChat Pay |

🌎Local payment methods | ACH, Alipay, Bancontact, Giropay, iDEAL, EPS, P24, Sepa, SOFORT, WeChat Pay |

-

The service works with 135 currencies which is a piece of good news for the customers.

-

Mobile app payment processing in Stripe is conducted on its own servers. And since you don’t have to store users’ personal data, you don’t have to worry about PCI compliance.

-

Payouts take more time than in Braintree - up to 7 days worldwide, 4 days for New Zealand but still 2 days for the US (except high-risk industries) and Australia.

-

Stripe offers advanced security functionality - a machine learning fraud system called Stripe Radar, Dynamic 3D Secure safety layer and others.

-

Broad reporting options through Web or App Dashboards. To build such reports you can use Stripe’s advanced feature called Stigma.

Pricing Details 💵

Pricing is almost no different from what Braintree offers:

- The standard rate is 2.9% + $0.30 per transaction applies.

- No setup or monthly fees.

- Stripe will charge 1% more if customers pay with an international card (that isn’t listed in the table a bit earlier) or if the payment currency differs from your payout currency.

- However, Stripe doesn’t have a fee-free option for the first $50,000 proceeded.

Development Details ⚙️

Stripe’s documentation is super clear, developer-friendly and well-structured.

Tip: your team can develop a nice & user-friendly payment form using Stripe’s custom UI toolkit.

To set up mobile app payment processing with Stripe check this documentation:

👨💻 Our Experience with Stripe: Text a Letter

By the way, we integrated Stripe in one of our clients’ projects called “Text a Letter”, where users can send real beautiful letters to their loved ones with several clicks from the app.

Payment Gateway in the Text a Letter app

The usecase was quite simple: we had to use Stripe’s SDK in order to be able to charge users’ credit card with the required amount.

Mangopay

This is one of the quite popular mobile payment gateways in Europe, typically used for marketplaces. So we recommend considering this option if you’re mainly focused on this region.

Also, unlike Stripe and Braintree, this service provides you with more tools to customize in-app purchases processing. For example, with Mangopay you can create an adaptive workflow for your business to dispatch payments for several accounts.

Think of Uber. When the customer pays for a ride, his payment is actually split in 2: to the driver (the first account) and to the Uber itself as a commission (the second account). That’s a system Mangopay can handle.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/12ab0f839a67ca291416563318ccb612996204ef-700x525.jpg?w=700&h=525&auto=format)

Mangopay is one of the top payment gateways in Europe (image by Eduard)

Gateway Details 🏦

- Mangopay’s accepted payment methods include cards and local services

Cards: Visa, Mastercard, American Express and Diners.

Local Payment Services within Europe: Masterpass (the only exception that works worldwide), CB (🇫🇷), Bancontact (🇧🇪), Bacs (🇬🇧), iDEAL (🇳🇱), Giropay (🇩🇪), Klarna (8 European countries), Przelewy24 (🇵🇱) and Paylib (🇫🇷).

The service also works within SEPA - the Single Euro Payments Area that covers Eurozone.

-

This mobile app payment provider supports 15 currencies (some international and almost all European currencies).

-

Mangopay offers tailored-made solutions for 3 cases.

Marketplaces can use Mangopay to accept and split in-app purchases, verify merchants, set up regular payments and easily work with refunds.

Crowdfunding initiatives will benefit from secured donations, the ability to verify organizations and design your own payment flow.

Fintech projects prefer this gateway because it allows verifying users and organizations, collecting funds with different means and escrowing funds for as long as you need.

- Another advantage is great user protection and fraud prevention functionality.

For example, the service is fully compliant with PCI-DSS, GDPR, and DSP2 - all regulations you need to follow so as to run your online business.

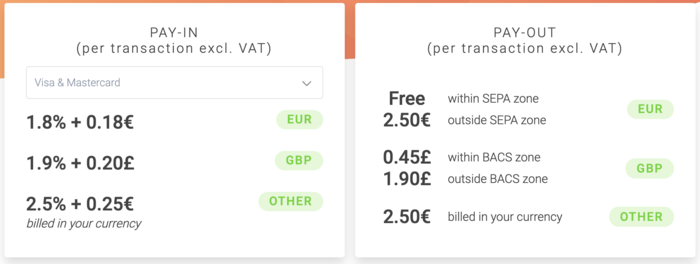

Pricing Details 💵

Mangopay has no hidden fees for setup, refunds, support, pre-authorization, etc.

Yet, the service has a branched pricing policy depending on the currency and payment methods. Just take a look:

Mangopay's pricing options

Pay attention, the table above applies only for Mastercard & Visa but you can check other payment options here.

Another interesting thing is Mangopay’s volume discounts. To put it short: the more pay-ins, the smaller the fee.

For example, if you reach 100,000 monthly pay-ins the rate drops from 1.8% to 1.6% for EUR and from 2.5% to 2.3% for USD. By reaching the next milestones you may drop it even more dramatically.

Development Details ⚙️

Mangopay offers SDKs for PHP, Phyton, Ruby, .Net, Node.js and Java.

The service also offers card registration kits for mobile platforms:

iOS | Android | JavaScript

👩💻 Our Experience with Mangopay: Oval Money

Mangopay is another payment gateway we’ve integrated for one of our clients. We used it for developing the MVP of the Oval a couple years ago. The idea of this FinTech App was to save money, based on your spending. So, for example, set up a rule to save $3 for each cup of coffee, which you drank this week.

And here’s how we used Mangopay in it:

- During the Sign-Up for a new user, we created a wallet for every new user in Mangopay.

- Users linked their bank accounts to that wallet with the help of Yodlee API.

- Mangopay charged users and transferred a pre-defined amount from their account to their Oval-wallet either on a regular basis or after specific actions (e.g. $2 each time you buy a cup of coffee).

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/5440842636c61cee0cd6dc6bde3e3e5c20bb3344-700x525.jpg?w=700&h=525&auto=format)

Shots from the Oval app (image by Rocco Barbaro)

Back these days, Oval was an early stage startup. And we’re proud, that now several years later it received first €1.2M and then £1.3M funding. Inspiring, right?

If you’re interested in learning more about this experience or have a similar case which needs to become a success story, drop us a line!

Authorize.net

Authorize.net is another option to consider if you need to choose a mobile app payment gateway. Despite it has a limited functionality comparing to Braintree, Stripe or Mangopay, it offers reduced rates for customers who already have their own merchant accounts.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/1a17043b860e2d38d673619ba629c016409b3fd1-700x525.jpg?w=700&h=525&auto=format)

Authorize.net is an alternative option for your mobile app (image by Luova Studio)

Gateway Details 🏦

- Despite this service works only with 9 payment methods, they include all the main ones.

Cards: Visa, MasterCard, American Express, Discover, JCB

eWallets: PayPal, Visa Checkout, Apple Pay & Chase Pay

-

Authorize.net supports 11 currencies, including the euro, dollar, and pound.

-

All operations within the service are PCI DSS compliant.

-

Authorize.net also provides you with easy-to-read reports, anti-fraud filters (IP, transaction or velocity ones) and the automated recurring billing system.

Pricing Details 💵

Here’s what you should know about Authorize.net’s pricing.

- No setup fees BUT $25 monthly gateway fee no matter what a plan you choose

The transaction fee depends on the chosen plan:

- Gateway Only: If you have a dedicated merchant account, you’re a lucky one. You can link it to Authorize.net to receive mobile app payments on it and pay only $0.10 per transaction and $0.10 once a day as a batch fee (to send all your transactions to the processing networks at the end of the day).

- All-in-One: If you need to set up both a merchant account and a gateway, you’ll be charged 2.9% + $0.30 per transaction.

Development Details ⚙️

To integrate this payment gateway in a mobile app use the following documentation:

BlueSnap

This is a complete payment solution for B2B and B2C businesses all over the world. The payment processor, gateway and merchant account are wrapped into a single quality product.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/720c563bf38ff77fead7f3b66966bded41d7151b-700x525.jpg?w=700&h=525&auto=format)

BlueSnap accepts over 100 currencies and works with more than 100 payment methods (image by Masudur Rahman )

Gateway Details 🏦

- This mobile app payment gateway claims to work with 110 world’s payment methods and supports 100 currencies.

Moreover, they vary from region to region, so we recommend checking the list of supported payment types for countries where your business operates. It can be done here.

Of course, BlueSnap supports the most popular payment methods like Mastercard/Visa/AmEx cards, PayPal, Apple/Google Pay and others. But the number of supported local payment methods is much higher than what Stripe and Braintree offer.

-

Security stack includes the 3D Secure technology fraud prevention services from Kount. By applying these multi-layer protection mechanisms you’ll significantly reduce risks and be able to implement a great fraud prevention strategy.

-

Use BlueSnap’s reporting tools to make data-driven decisions. For example, you may analyze conversion rates, track sales by currency, region, payment method or product and much more.

-

Of course, the service supports such important features as recurring payments, invoice payment processing, arranging marketplace split payouts and many others.

Pricing Details 💵

No setup fees and no monthly charges during the first year or if your transaction volume is higher than $2,500 a month (otherwise, the $75 fee applies).

Transaction fees vary greatly depending on the country and whether the transaction is cross-border or not. For example:

- The rate for the transaction within the US is 2.9% + $0.30 but for non-US transactions, it raises to 3.9% + $0.30

- For Europe rates vary from 1.40% + €0.25 to 3.45% + €0.25

You can check the needed country here.

Development Details ⚙️

If you decide to choose this mobile app payment gateway for your business, check the following SDKs:

PayU

PayU is a FinTech company that offers payment technologies to merchants. The company is owned by the multinational internet and media giant - the Naspers Group.

It has quite a branched system and separate websites as well as pricing models for different countries. Among them are some Eastern European, African, South American countries, India and others - 16 countries in total:

PayU supports 16 countries

Moreover, the Indian product - PayUmoney - managed to become one of the best mobile app payment gateways for businesses which operate in that country.

Gateway Details 🏦

- Available payment methods and currencies are tailored according to each country so local businesses can benefit from using PayU the most.

Of course, the most popular payment options like Mastercard and Visa cards are available for all countries. However, PayU also focuses on specific local banks, wallets and payments systems to give more value to businesses that operate in those countries.

For example, in Argentina customers can use Naranja, Cencosud or Tarjeta Shopping cards.

-

Activation of the PayUmoney account takes less than 5 minutes.

-

A built-in transactions management system helps to deal with refunds, settlements, and disputes from a single dashboard. Here you also can download reports across different data segments.

-

You can also benefit from the account management system that allows editing business & bank details, adjusting notifications and generating reports at a single place.

Pricing Details 💵

Pricing policies vary from country to country, so to get the most accurate info check the according website. List of all countries can be found here.

For example, some of the pricing models are:

- India: 2% fee per transaction (+1% for American Express cards) with no setup fee.

- Poland: a 79 PLN registration fee; 2.3% per transaction.

- Turkey: first 2 months or a total of TL 50,000 isn’t charged; then the rate of 2.50% + 0.30 TL applied.

As you can see, depending on the country rates may be either better than offers from other mobile app payment providers or worse. So check them carefully 🙂

Development Details ⚙️

Look for the “Developers” section at the top of the page after choosing your country from this list.

SecurionPay

If you’re choosing a mobile payment gateway for your business right now, SecurionPay may be a good option to consider. It was primarily designed to improve conversions, introduce cross-sales and, of course, provide a straightforward and fast way to accept transactions.

Let’s explore it more carefully.

Gateway Details 🏦

-

The service accepts cards as the main payment method. Accepted ones are Mastercard, Visa, American Express, Discover, JCB, and Diners. Other payment options include PayPal, SEPA and even Bitcoin payments.

-

SecurionPay works with merchants registered mainly in the European countries (full list here). Also, on the same page, you can check supported and excluded industries to see whether your business fits in.

-

The service offers a bunch of billing options to cover as many payment scenarios as possible. For example, you can set up one-time transactions, subscriptions, and other complex payment integrations.

-

Some of the most popular SecurionPay’s features are cross-sales (you can offer an extra product or service right after the initial transaction) and one-click payments (reuser user data to shorten the checkout process). SecurionPay claims to increase conversion rates by 35% after using the mentioned tools.

-

High-security standards include a 3D security layer, blacklisting to block suspicious customers, delayed capture for more accurate verification in controversial cases and others.

Pricing Details 💵

If you’re looking for a payment gateway for a mobile app with a completely transparent and clear pricing strategy, you’ve found it:

- No setup and monthly fees

- 2.95% + €0.25 for regular merchants

- From 4.9% + €0.35 for high-risk merchants (check their list here)

Development Details ⚙️

SecurionPay has SDKs for Java, PHP, .Net, Ruby, Python, and Ruby.

You can check all the documentation here.

Worldpay

Before rebranding, this gateway was formerly known as Streamline - a pioneer online payment platform. However, the service tries to adapt according to the evolving needs of businesses all over the world. Let’s see how.

{ rel="nofollow" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/abf71c594ea6554a8990ffda57c26e8b542706c3-700x525.jpg?w=700&h=525&auto=format)

Worldpay is another good option on our list (image by Thea Cheang)

Gateway Details 🏦

- Since Worldpay was designed to help eCommerce business, it supports many different payment methods.

Cards: Visa, Mastercard, American Express, Diners, Discover, JCB. Union Pay and Bleue.

eWallets: PayPal, Qiwi, Alipay, and others.

Alternative payment methods include local banks, mobile wallets, and many other options.

You can see the full guide on Worldpay’s payment methods in their brochure.

-

Worldpay offers your business an omnichannel tool. You can use it to manage transactions from different channels (web, mobile app, and even offline shopping spot) in one place.

-

The company also offers tailored security approaches for different industries, taking into consideration their specifics. So it makes even more sense to choose this mobile app payment gateway if your business fits in one of the following fields: airline, gambling, video games, retail, travel, digital content.

-

With advanced reporting possibilities, you can analyze your customers’ behavior and make data-driven decisions.

Pricing Details 💵

Pricing options may vary and are quoted individually. However, according to the UK version of the Worldpay’s website, the possible range of figures is:

- 2.75% + £0.20 if you pay as you go.

- 2.75% for credit cards (and 0.75% for debit cards) + £19.95 monthly fee.

These rates are negotiable if you accept over 1,000 transactions a month.

Development Details⚙️

You can check the Worldpay’s documentation here.

For mobile solutions, check the following docs:

We hope that this review of the 8 most popular mobile payment gateways will be useful to you as you choose one for your project. But before we finish, let’s check a comparison table. With its help, you can briefly recall services’ essential features.

📊 Comparison Table for Choosing a Mobile Payment Gateway

We understand it’s difficult to keep all the details in your mind. So take a look at this table before you make a final decision on choosing a mobile payment gateway for your business:

🏦 Payment Gateway | 💸 Standard Pricing* | ⏳ Payouts (in days) | 💳 Supported Payment Methods | 💶 Supported Currencies | ||

|---|---|---|---|---|---|---|

Braintree | 2.9% + $0.30 + first $50,000 free | 2-5 | Over 20: cards, eWallets, local methods | 135 | ||

Stripe | 2.9% + $0.30 | 2-7 | Over 20: mostly like Braintree but without PayPal | 135 | ||

Mangopay | 1.8% + €0.18 for euro; 2.5% + €0.25 for dollar | 2-5 | 16: cards and local payment services | 15 | ||

Authorize.net | $25 monthly gateway fee + $0.10 / 2.9% + $0.30 per transaction | 2-3 | 9: cards and eWallets | 11 | ||

BlueSnap | 2.9% + $0.30 | 1-3 | 110: cards, eWallets, and local payment services | 100 | ||

PayU | Greatly varies from country to country, check the website | 1-2 | Vary from country to country but include cards and eWallets | Vary from country to country but about 16 | ||

SecurionPay | 2.95% + €0.25 | 2-3 | About 11: mainly cards + PayPal, bank transfers and even Bitcoin | 160 | ||

Worldpay | 2.75% + £0.20 | 1-3 | Over 40: cards, eWallets, local payment services | 140 | ||

*The rate of 2.9% applies mostly for transactions in $ and within the US. For cross-border transactions, transactions from cards not issued in the USA or transactions in other currencies than $ higher rates may apply.

💡 Takeaways

Now choosing a mobile payment gateway will be a challenge, which you know how to master! Before making the final decision, always check whether a gateway meets your requirements in these fields:

- Make sure it supports payment methods that are the most natural & popular for your target audience. The same is true for currencies.

- Check whether the service provides you with the needed features. For example, it may be recurring payments for subscription-based businesses.

- Finally, if you found a few providers that match all the requirements from the previous two points, compare their pricing models. But don’t think of it as the most important factor.

To choose a mobile app payment gateway is only half the way - you still need to implement it. And if you need any support with this - our team can help you with that challenge!

Contact us and we’ll help to integrate the selected Payment Gateway to your Product.

![Stormotion client Pietro Saccomani, Founder from [object Object]](/static/40e913b6c17071a400d1a1c693a17319/b0e74/pietro.png)