Car Insurance Mobile App Development: a Full Guide

Published: June 9, 2025

18 min read

In this article, you'll learn:

1

🌐 Auto Insurance Market Overview

2

📈 Benefits of Car Insurance Apps

3

📱 Features of an Auto Insurance App: Your Top 7 List

4

🚘 Extra Features For Your Mobile Car Insurance App

5

🛠️ 8 Steps of Developing a Car Insurance App

6

⚙️ Tech Stack For Car Insurance App Development

7

🔴 Challenges of a Car Insurance App Development

8

💰 Cost to Build an Insurance App

9

🗂️ Why Choose Stormotion

10

💡 Takeaways

Are you looking for new ways to improve the quality of service for your mobile audience? Or do you want your audience to be more loyal to your car insurance brand? A car insurance app development can help you achieve both!

According to Statista data, people spend about 57% of their time on mobile apps and only 43% on computers. That’s why your website (even optimized for mobile) can’t give you great results.

If you’re reading this article, you want to learn more details about how to build a car app and what to expect along the way. In this guide, we’ll break down:

- The global market situation;

- Benefits and challenges of car insurance mobile app development;

- Must-have and extra features of the vehicle insurance app;

- Steps Stormotion takes to build a mobile app;

- The tech stack we use to develop an insurance app;

- The average cost to create a car insurance app.

Why trust us? We have built mobile applications for bus ticket price comparison and booking, white-label apps for CPOs, kiosk apps for EV charging payment terminals, e-scooter apps, and many others. You can find out more about them in our portfolio.

You can also watch a video where Tino Marx, CTO of CheckMyBus, shares his thoughts about our collaboration and the results his company achieved after building a mobile app.

So, let’s start with a car insurance market overview!

🌐 Auto Insurance Market Overview

According to the TechSci Research report, the global auto insurance market was valued at $941.57 billion in 2024. And it’s going to reach $1,526.07 billion by 2030. Three main factors drive this growth:

- More people buy cars for personal use around the world.

- Governments implement stricter car insurance rules.

- Digitalization transforms the way insurance companies do business.

The popularity of electric vehicles and the development of self-driving technologies also cause changes in the insurance industry. At the same time, usage-based insurance (UBI) is gaining popularity since people are looking for more flexible and customized insurance solutions.

UBI (Usage-Based Insurance) is a type of auto insurance where the premium is calculated based on how, when, and how much your clients drive, in addition to factors like age, gender, or location.

Insurance companies use telematics technology via mobile apps or built-in vehicle systems to collect real-time driving data and adjust pricing.

To adapt to these changes, insurance companies are starting to use technology like telematics, AI, and big data. These practices help them better understand the risk for each customer, make better pricing decisions, and get more people to use their services.

And, of course, they invest in auto insurance app development. Let’s see what they get in return!

📈 Benefits of Car Insurance Apps

Car insurance apps are beneficial for both insurance providers and their customers. Look at the details in the table.

Benefits for Customers | Benefits for Insurance Providers |

|---|---|

Customers can view policy details, renew coverage, update personal info, and access digital ID cards anytime and anywhere. | You can reach your customers via push notifications, personalized offers, and timely reminders. They can buy additional insurance and roadside services with just a few taps, leading to your revenue growth. |

Users can report accidents, upload photos, and request roadside assistance using your app. | Apps can process insurance claims faster (you can also automate it). You reduce the workload of insurance agents, providing them with more time for other tasks (for example, to acquire new customers). |

Customers can solve their problems via chatbots or live chat. They can find answers to FAQs, check billing inquiries, or claim status in the app. | You’ll need fewer agents and can cut operational expenses since mobile technologies (like chatbots or live support) will deal with your customers. |

Users can compare pricing options, apply promo codes, and even track behavior-based discounts (e.g, safe driving rewards) in the app. | Car insurance apps make your business more transparent with deep usage data, behavior analytics, and driving patterns analysis. You’ll make more data-driven decisions, like personal offers and upselling campaigns. |

The app stores all important information, from e-policies to billing history. Your customers don’t have to keep physical copies of their documents. | You can differentiate your business from outdated competitors and grow faster. Users can access your services via a mobile application even if you don’t have an office in their city or region. |

The benefits of a car insurance software are quite obvious for you (after all, that’s how you turned up on this article, right?)

Ready to bring these benefits to your customers? We can help you build a car insurance app that meets your business goals.

Let’s talk

But how to develop a car insurance app that will increase the level of service, brand loyalty, widen the number of your customers, and, as a result, increase the yearly income per client? Which features should the app have? Here’s how we see it at Stormotion!

📱 Features of an Auto Insurance App: Your Top 7 List

During car insurance app development, it’s necessary to keep the balance:

- Your application should meet user expectations, work smoothly, have a nice UI, and improve the way you deliver services to them.

- At the same time, it’s better to start with a Minimum Viable Product (MVP) and develop gradually, so you don’t waste your time and resources.

Let’s take a closer look at the features of an auto insurance app MVP!

# 1: Vehicle Information Screen

Quite obvious that before a user buys the insurance, they should provide some details about their car. The typical workflow is to ask them to fill in some information about their car: year, make, and model.

Moreover, you can improve such a standard and boring procedure when you create a car insurance app. Let the UK-based Cuvva car insurance application inspire you!

Cuvva has already sold over 11 million policies, insured 2 million cars, and got 4.5 million app downloads by 2024. Such success can be explained by their user journey.

Their users should only enter the vehicle’s registration plate. Due to the integration with the GB DVLA, the app extracts all the car data straight from this database, killing two birds with one stone:

- It simplifies the whole process from the user’s side.

- It extracts data from the official database, leaving almost no room for mistakes or fraud.

📌 You can also read our article on how to build an EV rental app, since the vehicle information screen is one of the most important for them.

# 2: Quotes Screen

When the basic info is entered, it’s time to offer users available insurance services and plans.

Here are a few recommendations to follow:

- Place one plan per page. It will focus users’ attention on it and let you provide all the key details. Also, users can move to the next plan by swiping right or down.

- Use bright and catchy colours for the CTA buttons. It’s a known technique to draw users’ attention and push people towards the desired action.

- Don’t hide real prices. It annoys people a lot, so make sure that they won’t face any difficulties when trying to understand how much your services are going to cost them.

As the automotive industry moves towards sustainable practices, you can integrate features with e-mobility meaning. Insurance plans for electric vehicles and bonuses for eco-friendly driving habits can position your car insurance app as a forward-thinking solution in the era of electric mobility.

# 3: Payment Processing Screen

When a user is interested in a specific insurance plan, don’t waste time and close the deal! During a car insurance mobile app development, we can integrate a smooth and secure payment gateway, either Braintree or Stripe, for this purpose.

From the UI perspective, this screen should include some basic info about the chosen insurance policy from the previous screens, like:

- Insurance type;

- Policy length (or duration);

- Start and end dates;

- Total price.

Also, this is the right moment to remind them about legal obligations since it’s the last step before users exchange their money for your insurance guarantees. Therefore, leave a place for a “Policy & Terms” button.

Since you want to create a car insurance app for an audience that’s on a first-name basis with mobile technologies, they should be able to save their credit cards for quick payments & access in the future. Keep in mind: this kind of data requires special protection and compliance with PCI-DSS (Payment Card Industry Data Security Standard).

📌 EV apps should also have a payment processing feature, affecting the cost to develop an EV charging station finder app like PlugShare.

# 4: Support Screen

One of the advantages of your mobile car insurance app or similar solutions, like EMSP software development, is the simplified interaction with your company. How can it be implemented? Through a support chat!

It opens a bunch of new possibilities for your users:

- A 24/7 Live Support provides users with any kind of help from your professionals.

- It can become a source of up-to-date information about the claims processing.

- Chatbots can help users navigate through the car insurance apps and provide answers to basic questions. This approach mirrors the car rental mobile app development approach, where chatbots and customer support improve user experience.

📌 Similarly, adding a support feature is important when learning how to build an e-scooter app to provide users with real-time help.

# 5: Policy Review Screen

Of course, users should always have direct access to their insurance IDs. The typical solution is to add a separate screen (it’s usually known as the Policy Review or ID Screen) where users can check a policy type and number, vehicle specification, effective and expiration dates, etc.

# 6: Claim Filing Screen

The insurance business may be the only industry in the world in which both you and your clients hope that there will never be a REAL NEED to use your services.

However, you definitely need to add the Claim Filing Screen during the insurance application development. Its main goal is to simplify and speed up the claim processing.

Moreover, a chatbot can eliminate paperwork. Users will file claims without involving your staff. Isn’t that a great example of optimization and service quality improvement at the same time?

From the development perspective, there are several solutions that your Tech Partner can implement:

- Create a chat (don’t confuse it with live support) where users can file a claim in real-time.

- Another solution is to integrate claim processing into the live support chat. It will eliminate the need to create a separate screen and simplify the navigation within the app.

- Finally, we can build a car insurance app with a chatbot that will help to quickly report the accident (just like in the State Farm mobile application).

# 7: Push Notifications

We can’t imagine how to create a car insurance app without push notifications. Why do you need them?

- To keep users informed about how their claim processing is going.

- To encourage them to use your insurance services if they left the app at some stage.

- To remind users to renew the insurance if their policy is going to expire soon.

As you can see, push notifications can serve both marketing and service purposes, providing noticeable benefits for your business and customers at the same time.

These are the essential features of an auto insurance app that ensure basic functionality and cover your audience's expectations.

When your app showsa good retention rate and you managed to get an additional budget, you can add advanced functionality to the app. Here are several ideas for you 👇

🚘 Extra Features For Your Mobile Car Insurance App

At Stormotion, we take a long-term perspective on our clients’ projects. Therefore, we try to plan a few steps ahead, including what features don’t fit the initial MVP scope but can be delivered in the next releases. Here are our ideas for extra features for vehicle insurance apps!

# 1: Chatbots

Already mentioned chatbots are a great example of advanced functionality that can be kept for further releases. Yet, since they are involved in direct interaction with your customers and can greatly improve the UX, we recommend planning it for one of the early post-release updates.

They will assist users 24/7, guiding them through policy details, claims, and other support requests without involving your team.

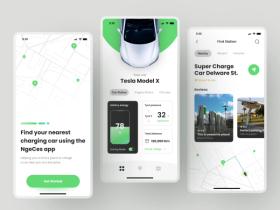

# 2: Telematics Integration

If you want to create a car insurance app that will go even beyond users’ expectations, try combining telematics with GPS services and motion sensors. This approach is used in Allstate and Root car insurance applications.

According to Insurance Journal, 72% of global car insurance companies use telematics technology to offer usage-based policies.

In a few words, the idea behind this nontrivial combination is to analyze driving behavior and provide users with rewards (for example, decreasing the cost of an insurance policy) based on this data. Meeting the criteria of “better driving” usually means:

- Not going above some speed limit (in the Allstate app, they have 80 mph, which equals about 120-130 kph).

- Limited night-time trips.

- Smooth braking and turns.

Telematics enables an alternative approach. It provides a way to focus on granular risk by offering unparalleled visibility and objectivity, leading to fair and precise assessment of mobility risk — and to profitability.

Matt Scheuing, CEO of SambaSafety

# 3: Roadside Tools

You can improve your mobile application with different roadside tools. It can include any services that will be useful to the drivers: fuel delivery, tire change, jump start, gas station finder, parking reminder, and so on.

# 4: AI and Machine Learning

You can also add AI features to one of the early updates after your MVP car insurance mobile app development. They can help automate risk assessment based on user data and driving behavior, making premium calculations more accurate and transparent.

Additionally, ML models can analyze photos of car damage to speed up approvals.

📌 Find out how to implement AI into an app in our dedicated guide!

# 5: IoT and Connected Cars

If you offer insurance policies to connected vehicles, you can integrate IoT tools into your app. These devices track things like braking patterns, mileage, and speed.

On top of that, IoT enables proactive maintenance alerts and can even detect accidents in real time to trigger emergency responses. It’s a powerful way to go beyond traditional coverage and offer real value to users.

📌 You can read more about these technologies in our articles on how to create a connected car mobile app and create an EV companion app.

Keep in mind that you can add these are additional features during the next iterations of the insurance application development. Don’t waste your time and budget on advanced functionality. First, grow your customer base and get a steady revenue stream.

🛠️ 8 Steps of Developing a Car Insurance App

This is one of the most important parts of the guide, since we’ll cover the steps where all the app development magic happens.

# 1: Define Business Goals and Research the Market

Before diving into design mockups or architecture diagrams, you should clarify what you want to achieve with the app. Are you optimizing operations, improving user retention, going for a UBI model, or all of the above?

At this stage, you should also analyze your competitors’ features and business models to identify what could give your app a unique edge.

# 2: Find a Reliable Development Partner

The auto insurance app development is rather something that requires a reliable Tech Partner alongside.

Except for the development process, your tech partner should conduct a Discovery Stage to understand what exactly you’re trying to achieve with your product and come up with a list of core features for the car insurance app.

To get more information on what a Discovery Stage is and what steps it includes, read our article where we talk about the Project Discovery in detail:

# 3: UI/UX Design

The vision is clear. Now, it’s time to translate it into wireframes and interface flows. Car insurance apps deal with complex data, like claims management, coverage, billing, etc.

And the designer’s goal is to make everything as intuitive and user-friendly as possible. Keep the app design clean, use icons to reduce text mess, and make sure it’s easy to navigate for users of all ages.

# 4: Compliance & Data Security Setup

Your app handles sensitive data like user profiles, payment details, and claims-related documents. Depending on your target market, there are several data protection regulations your app might need to comply with.

For example, in the EU, it’s GDPR, a strict regulation that requires user consent for data collection, clear privacy policies, and the ability to delete user data upon request.

You might also follow insurance-specific rules like the NAIC Insurance Data Security Model Law, which outlines how insurers should manage and protect consumer data.

On the technical side, the car insurance app development team should implement end-to-end encryption, secure login, multi-factor authentication, and role-based access controls to prevent unauthorized access to the sensitive data of your users.

# 5: Develop the Car Insurance App

Now, it’s time to bring your idea to life through code. Our app developers usually start with an MVP that includes core features like policy management, claims filing, and support chat. This will allow you to launch faster, test the market demand, and improve the app based on real feedback.

# 6: Launch, Test & Monitor the App

Once you create a car insurance app, it’s time to make sure everything works exactly as expected. Our QA Engineers conduct manual and automated testing, performance checks, before delivering your app to users.

Now, you can deploy the app on Google Play and the App Store, where you can monitor its performance. Real-time feedback and crash analytics will help you catch and fix early issues before they impact users.

# 7: Analytics & Monetization

After launch, data is your best friend. Analytics helps you understand what’s working and what needs improvement. If monetization is part of your strategy, this is also the stage to test paid add-ons, partner integrations, or usage-based pricing models.

# 8: Provide Ongoing Support

Building an app is just the beginning. Regular updates, bug fixes, feature improvements, and support requests will keep your app relevant and reliable in the long run. You can hand it over to your tech partner who knows all the details of your application.

Looking for a reliable Tech Partner to guide you through car insurance mobile app development?

Reach out to us

⚙️ Tech Stack For Car Insurance App Development

The right Tech Stack can significantly decrease the required time and cost to develop a car insurance application. Moreover, the right tools can ensure the smooth work and great UX of your app. That’s why it’s important to choose the proper set of APIs and SDKs.

Our Stormotion Developers recommend using following tools to develop an app for a car insurance company:

- Braintree SDK, Stripe API - to process in-app payments.

- Firebase API or OneSignal SDK - to implement push notifications.

- Vehicle Status or DVLA Search (for the UK companies) APIs - to get all the details about vehicle’s status and eliminate the extensive paperwork.

- Google Roads API - to define the speed limit for a given road segment.

- Theft Alarm API - to alert users if someone is trying to damage or steal his car.

- As always, we recommend building the app using React Native since it’s a perfect choice if you want to create a cost-effective cross-platform application with native UX.

During the Discovery Phase, we choose what tech stack suits the project the best and discuss all details with our clients.

🔴 Challenges of a Car Insurance App Development

We’ve talked a lot about the benefits of car insurance apps. Now, it’s time to discuss challenges you can face during insurance application development.

Challenge | What It Means |

|---|---|

Regulatory compliance | Depending on your region, your app may need to comply with GDPR (EU), CCPA (California), PCI-DSS (payment processing), the Customer Protection Act (US), or even niche regulators like the Prudential Regulatory Authority (UK) or Financial Services Regulatory Authority (Canada). But a trusted Tech Partner will help you meet the requirements of each of them. |

Data security & privacy | Apps that handle personal info, policy details, or payment data must have strong encryption, secure login flows, and role-based access controls. Your users should feel that their personal data is in a secure place. |

Scalability & future-proofing | What works for 1,000 users may not work for 100,000. Build your app on modular architecture, use cloud infrastructure (like AWS), and support CI/CD pipelines to scale fast. |

Integration with telematics software | If you want to use telematics to track driving behavior or offer usage-based policies, your Tech Partner should know how to connect GPS, sensors, and third-party platforms to your app. |

Integration with legacy systems | Legacy systems often store essential customer data and policy logic. You can connect your new app to these old systems if you have a proper integration strategy. The other way is to modernize your outdated software. |

Policy migration | Moving thousands of existing insurance policies into your new app is no small feat. You’ll need a migration plan, data cleanup, testing, and possibly automated tools to ensure no information is lost in transit. |

With the right Tech Partner, clear strategy, and attention to detail, you can create a car insurance app that meets the needs of your customers.

💰 Cost to Build an Insurance App

If you're interested in the cost of developing a car insurance app, see the estimate below.

Estimated Cost of MVP Car Insurance App in Hours

Using React Native

⚙️ Features | ⏳ Min Hours | ⏱ Max Hours |

|---|---|---|

🛠 Setup Technical Foundations | 12 | 16 |

⚙️ Common Dev Tasks (Build Preparations, GIT-Flow, etc.) | 34 | 46 |

🎨 UI/UX Design | 60 | 100 |

👋 Onboarding | 8 | 12 |

📋 Quoting Flow | 78 | 100 |

Fill in the driver’s data | 12 | 16 |

Fill in the car’s data | 18 | 24 |

Insurance plan screen | 12 | 16 |

Detailed plan info | 16 | 20 |

Recall quote | 20 | 24 |

💸 Payment Flow | 40 | 50 |

📝 My Insurance | 12 | 16 |

📋 Claiming Flow | 124 | 158 |

Choose a type of claim | 36 | 48 |

Take photos of the damage | 28 | 36 |

Review the claim | 20 | 24 |

My claims | 40 | 50 |

🤙 Support Flow | 48 | 56 |

Live chat | 36 | 40 |

Check your agent’s profile | 12 | 16 |

🚚 Roadside Assistance Flow | 138 | 172 |

Select a service | 24 | 32 |

Reveal your location | 50 | 60 |

Track the help on the map | 64 | 80 |

🔔 Push Notifications | 24 | 30 |

⛓️ Backend Development | 150 | 200 |

🔗 Third-Party API Integration | 100 | 120 |

🧪 Testing & QA | 120 | 160 |

📱 Deployment | 12 | 16 |

⏱ Total Hours | 960 | 1,252 |

💵 Approximate Costs | $48,000 | $62,600 |

So, the approximate cost of car insurance mobile app development is between $48,000 and $62,600. We used the average hourly rate for Eastern Europe - $50/hour.

If you want to get a more accurate estimate for your project, contact us! After discussing the details of your app and conducting the Discovery Stage, we'll give you a precise estimate of the costs for developing a car insurance app.

Would you like us to calculate how much development will cost for your car insurance app?

Contact Us

📌 Get insights on the cost to make a Lime-like scooter app in our detailed cost breakdown, based on real-world experience!

🗂️ Why Choose Stormotion

At Stormotion, we offer mobile app development services for industries where real-time data, security, and seamless customer experience are non-negotiable.

Our developers helped our clients create reliable, scalable, and user-friendly apps for e-scooter fleets, EV charging networks, ticket booking apps, to name a few, meeting their complex tech requirements.

What makes us a great fit for your car insurance app development?

We think of your project like our own. From day one, we aim to meet your product goals, overcome challenges, and build a premium-level app. Our React Native app developers have experience working with telematics data, location-based services, and secure user flows. And they can use their skills and knowledge for your projects!

💡 Takeaways

Now you have everything to create your auto insurance app: a list of features, a development workflow, and a set of technical tools for your project.

Let’s summarize the key points of this guide:

- Car insurance mobile apps offer benefits for both providers and customers: faster claims, real-time support, data analytics, and reduced operational costs.

- You can start with an MVP and focus on core features like vehicle info entry, policy management, quotes, payments, claim filing, and support. Expand later with chatbots, telematics, and AI.

- You should use a proven development roadmap: do market research, choose a reliable Tech Partner, design and build the user-friendly app, ensure compliance, conduct QA, and gather user analytics.

- The cost to develop an MVP car insurance app can range from $48,000 and $62,600, depending on your app type (native or cross-platform) and the number of features you want to integrate.

We can share our experience and knowledge with you and become your Tech Partner that will help you deliver a top-notch mobile product for your audience.

Ready to start car insurance app development? We’re happy to answer your questions and start the Discovery Phase of your project!

Our clients say

![Stormotion client David Lesser, CEO from [object Object]](/static/93e047dadd367691c604d8ffd1f54b58/b0e74/david.png)

They were a delight to work with. And they delivered the product we wanted. Stormotion fostered an enjoyable work atmosphere and focused on delivering a bug-free solution.

David Lesser, CEO

Numina

Was it helpful?

Questions you may have

Take a look at how we solve challenges to meet project requirements

How long does it take to develop a car insurance mobile app?

It depends on the app’s complexity. If we’re talking about a basic MVP with core features, it can take up to 5 months. For more advanced solutions with integrations, custom logic, and analytics, it can take 9 months or more. The Discovery Stage helps clarify that, so there are no surprises for you later.

Can you integrate an insurance app with existing CRM or policy systems?

Absolutely, integration is a must in this space. We can integrate a modern cloud-based CRM or a legacy policy system into your car insurance app.

How do you ensure compliance with insurance regulations like GDPR or HIPAA?

We conduct the Discovery Stage to define region-specific requirements that your car insurance app needs to comply with. During auto insurance app development, we implement encryption, secure login flows, role-based access, and data handling policies.

What’s the difference between a car insurance app for brokers and for direct insurers?

Car insurance apps for brokers are multi-policy platforms where users can compare, manage, and even switch between providers. Apps for direct insurers are more focused. They include policy management, in-app claims, renewals, and direct customer support under one app.

Do car insurance apps require native development or is cross-platform enough?

Cross-platform development is usually more than enough for vehicle insurance application development, especially with tools like React Native. It lets you move faster, cut costs, and maintain one codebase across both iOS and Android without sacrificing performance or UX.

Can users file claims directly from the mobile app with photo/video proof?

Yes, it’s one of the top features users expect in a car insurance app. We can build a claim process that allows users to upload photos, videos, and supporting documents from their phones. You can even add geolocation or time-stamping to make the process smoother for both users and claims teams.

Read also