Which BaaS Provider to Choose?

Published: May 2, 2022

19 min read

In this article, you'll learn:

1

👍 How You Can Benefit from BaaS

2

✅ The Difference Between BaaS & Open Banking

3

❓ How to Choose a BaaS Provider?

4

💻 BaaS Providers: Case Study

5

💡 Takeaways

Nowadays, the digital fintech industry is surging — the value of it is considered more than $5500 Billion, with a 24% annual growth. The transformation implies its opening up and tendency to start providing other parties with access to their functionality and data.

Such conditions on the market encourage banks & fintech companies to create their own infrastructures, so-called Banking-as-a-Service ecosystems.

If you want to know how to choose BaaS provider, check out our article (image by Prakhar Neel Sharma)

In fact, BaaS providers are game-changers for many businesses that want to provide fintech products or services but don’t have the essential infrastructure for it. The possible functionality that providers can enable include online banking, credit issuing & scoring, spendings optimization, branded banking card issuing & others.

But the problem is that such a rapid development of the BaaS industry caused the emergence of many new players on the market. Thus, it’s not always easy to choose one that meets your business needs the best.

So, if you’d like to learn more about one of the most trustworthy BaaS providers & find some tips on how to choose one — welcome!

👍 How You Can Benefit from BaaS

Such services can make it easy for your business to implement fintech services or products into the workflow. But let’s take a look at what _easy _implies.

# 1: Full Financial End-to-End Provision 📑

If you want to start working in fintech without a BaaS provider, it means that you’ll have to do a bunch of actions at various financial institutions. They can include:

- Account opening.

- Getting license.

- Ledger accounting & many others.

BaaS provider for FinTech offers you full end-to-end provision (shot from Bankable)

What’s great about working with BaaS is that you won’t need to do any of this. Providers normally connect your business to their financial infrastructure, which already has everything prepared.

Long story short, you can bypass these steps by using ready-made financial infrastructure & integrating your platform with an API of a BaaS provider.

# 2: Development Speed & Costs 💲

Creating a custom financial infrastructure might be more time-consuming and expensive, compared to working with Banking-as-a-Service providers. For instance, the banking license itself can take from 9 months to 3 years, depending on the country.

Besides, it’s possible that you would work with a lawyer, have to pay fees to financial institutions, etc., which makes this path more challenging in terms of the budget.

BaaS provider for Fintech can help you save money and time (shot from Adyen)

So, naturally, since in case you cooperate with BaaS & everything is ready for you to use, you can actually start providing fintech services in a week or so.

Additionally, you would only have to pay for the services of your provider - it’ll really help with cost optimization.

✅ The Difference Between BaaS & Open Banking

There are two terms in the fintech industry — BaaS and Open Banking — that get confused most of the time. So that you can find the most suitable solution for your business needs, we’d like to quickly recall the difference between them.

Open Banking

Open Banking is a process of financial institutions exchanging information with third-party providers (TPPs). Such TPPs are most often fintech or fintech-related start-ups like mobile banking apps, companies that work with cryptocurrency, blockchain, etc.

Normally, the data from different sources would be transferred to a mutual platform to enable an integrated data overview. The exchange channel is arranged by using APIs in most cases. There are 3 main types of such interface:

- Public — TPPs can access consumer data but have no right to store it.

- Partner — an exchange of enterprise data. Mostly used for ERP and B2B communications.

- Internal — an API for data management within one organization.

HSBC provides open banking services (shot from HSBC)

Open banking is quite a popular service that many financial giants provide:

- HSBC.

- Lloyds.

- The EU banks. In fact, they’re now mandated to provide open banking services by PSD2.

- Citibank & others.

Such services can be used for a variety of purposes from improving customer experience to optimizing the workflow of big companies as well as SMEs. Let’s take a look at a couple of general examples:

- For customer experience improvement, open banking can help users overview spending habits, instantly access bank accounts and markets for investments, have better security, access interest rates, credit scores, and so on.

- Insurance companies can benefit from open banking since they can access all up-to-date information about applicants.

- Small businesses, for instance, can overview their financial situation for data-driven decisions in terms of paying/taking loans, cost optimization, etc.

Banking-as-a-Service

BaaS is a system where a bank or fintech company gives you an opportunity to integrate their financial infrastructure into your app or website.

It’s a great option for startups and businesses that want to create a FinTech product but don’t plan to set up their own financial infrastructure. Using BaaS, companies don’t need to apply for licensing or comply with many financial regulations since you actually never “touch” the money that you work with. Meaning that all financial operations are conducted through your BaaS provider’s system.

BaaS can serve for a wide range of goals and business needs that can include:

- Core banking - payments, loans, mortgages, accounts access, etc.

- Card issuing.

- KYC.

- Credit scoring.

- Currency exchange & others.

OpenPayd BaaS Provider for Fintech (shot from OpenPayd)

BaaS is enabled by APIs integration of the chosen provider. Some of the most famous are:

- SolarisBank.

- RailsBank.

- Marqeta.

- Mangopay.

- Treezor.

- Starling Bank & others.

BaaS vs. Open Banking

The difference between these two services is quite fundamental since they serve different purposes. When working with BaaS systems, parties fully or partially integrate the financial infrastructure of providers into their products.

In open banking, however, businesses access providers’ data only, meaning they don’t implement any of the features of financial institutions — they either have their own ones or simply don’t need any.

The example of how BaaS provider for FinTech can be used (image by Extej Design Agency)

So, the crucial thing to remember is that different from BaaS providers, the TPPs can’t conduct fintech services since they don't have the legal permission to do so. What happens, in reality, is that they redirect account info from financial accounts to get insights or initiate transactions.

❓ How to Choose a BaaS Provider?

Not all providers can meet your business needs the same way. For example, some of them may not match country-specific regulations, others don’t support a needed scope of features.

Moreover, it won’t be that easy to change the BaaS provider later as all of your customer interactions will be linked to its financial infrastructure. Thus, pay special attention to the following factors when choosing a BaaS provider.

# 1: Business Needs & Budget 📊

First and foremost, your use case is one of the most decisive factors since different companies might be better at certain fintech aspects.

For instance, a provider can be one of the greatest ones in fintech insurance services yet an average when it comes to card issuing. Additionally, if you have a limited budget, some providers can fall away because of the pricing policy, which narrows the range down.

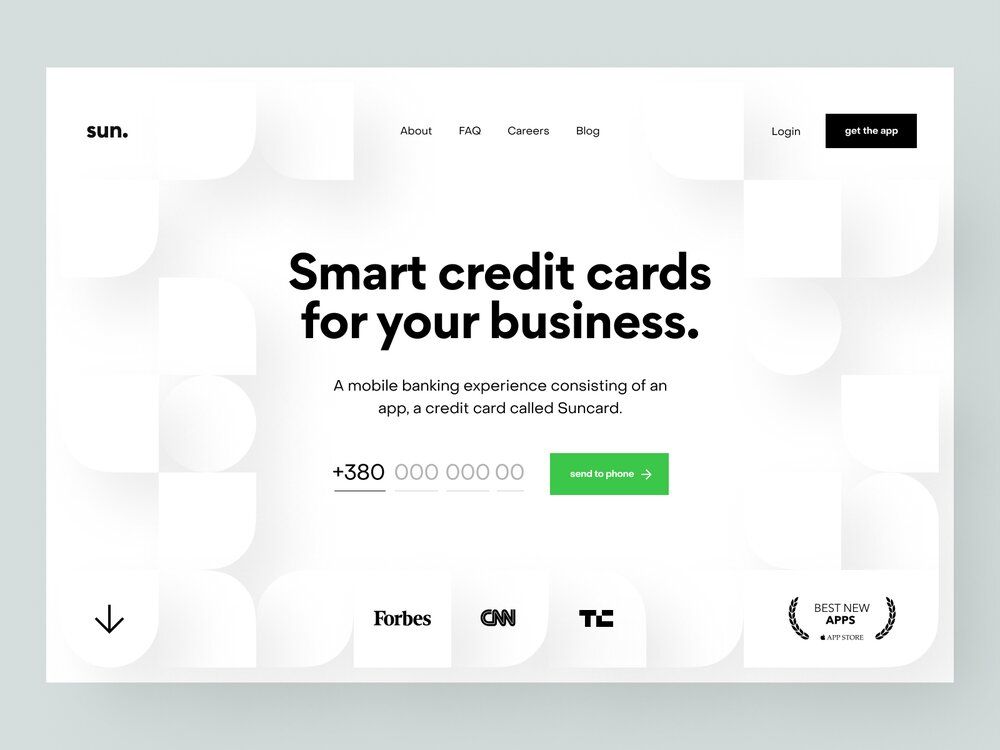

Such a BaaS provider for FinTech can help you with card issuing (image by Vladimir Gruev)

Let’s take a look at the example. The German fintech company offers freelancers to create a business banking account where all financial operations can be managed.

Additionally, they analyze these operations and keep an accounting of freelancers’ ledgers — in Germany it’s quite a challenge since all taxes are paid a year after the income reaches the account.

So, this company fully uses SolarisBank for financial infrastructure, while all non-financial business processes remain within their jurisdiction.

# 2: Regulatory Compliance 📚

Apart from a banking license, there are other regulations: GDPR, PSD2 & other legal cybersecurity documents that you might want your provider to comply with.

BaaS providers help you with regulatory compliance (image by Jenna Campbell)

Such a necessity can be conditioned by the type of your business, country of its registration, whether you work internationally or not, etc. So, when choosing a provider, consider looking up all regulations they’re compliant with — this info is available on the website in most cases.

# 3: Each Feature Under One Roof 💼

Sometimes it happens that BaaS providers create a net of organizations and institutions to cover as many customers' needs as possible. It might end up being a little bulky and complicate the process of integrations.

So, we’d recommend opting for a provider that would be able to enable each feature within a single API, even if they work with several other organizations.

Even though it’s not likely that potential providers would organize their workflow inconveniently, we thought that you should keep that in mind.

# 4: Loyalty & Branding 😀

Since the ability to brand fintech products can be essential for some businesses, you should get to know which providers offer such an opportunity or not.

Top BaaS providers help you with brand loyalty (image by Adrian Reznicek)

Here are some questions you can ask yourself before choosing a provider: \

- Do I want my customers to be able to get metal branded cards?

- Will clients need dedicated customer support?

- Do I need loyalty points for my business?

Sure thing, each case is unique when it comes to branding needs, but don’t forget to check if providers specialize in branding as well or they just give you a “Starter Kit” in advance.

💻 BaaS Providers: Case Study

In this section, we’ll overview the 5 most widely-spread trustworthy BaaS providers. We’re going to talk about:

# 1: Mangopay 🥭

Mangopay is a financial service provider from Luxembourg that works with marketplaces, e-retailers, crowdfunding platforms, and fintech companies (which we’ll talk about).

Mangopay is one of top BaaS providers (shots from Mangopay)

Regarding fintech services, Mangopay offers:

- Multiple payment methods (Visa, Mastercard, American Express, Diners Club, Maestro, and others).

- e-Wallets with IBANs & their management, which, for its part, includes an unlimited number of e-Wallets created, unlimited escrow time, free transfers, secured funds, and payments splitting.

- KYC features (User-Verification). To be compliant with necessary anti-money laundering regulations, you’ll need to check your customers’ identities, which Mangopay can help you with. However, there are some legal limitations — you can find this info here.

- White-labeling. The functionality includes adding-on your branded app on the fintech infrastructure, using a template, local & international payment methods, tokenization, etc.

- Fraud prevention. In terms of security, Mangopay offers their clients 3DS protocol protection, card fingerprinting, deferred payments, etc.

If you’d like to get some visualized summary of what we’ve covered so far, you could watch this video from the company:

When it comes to financial and data protection regulations, Mangopay fintech services are GDPR, DSP2, PCI DSS compliant. Additionally, they adopt their clients’ products & services to local financial rules. Their current banking license covers businesses registered in the 31 countries of the European Economic Area.

Mangopay has the following advantages:

- Diverse payment options.

- Financial flow customization.

- High-level security & regulatory compliance.

- Real-time transactions monitoring.

- Branding opportunities.

Somewhat unpleasantly can be the fact that there’s no free trial period & their API doesn’t support desktop devices.

Mangopay has all API documentation linked on their website if you’d like to become familiar with it.

So, to actually start working with Mangopay, the steps would be the following:

- Create a Sandbox Account.

- Complete the onboarding verification to go live.

- Sign the contract.

- Create a production account.

For more information, you can follow this link to reach Mangopay's “Getting Started” page.

Mangopay: Our Expertise

We at Stormotion have worked with integrating Mangopay for one of our very first clients — OvalMoney. Their main idea was to create a service that would allow users to make savings while spending money.

Let’s take an example. Many people drink coffee in the morning which can be costly if done on a regular basis. So, to make a financial profit out of it, every time one buys coffee, $3 is automatically transferred to a savings account.

What we did with Mangopay API was the following:

- During a new Sign-Up, we made an app to create a wallet for each one of them in Mangopay.

- Users can attach their accounts to this exact wallet — we used Yodlee API.

- Then, OvalMonеy was allowed to transfer a predetermined amount of money from users’ Mangopay account to their Oval-wallet. It could be done either once in a certain period of time or after a purchase.

Moreover, we have an article fully dedicated to developing your own digital banking app if that’s your case. Check it out here:

# 2: SolarisBank ☀️

SolarisBank is a German BaaS provider based in Berlin for corporate and online banking fintech services.

To get a quick visual introduction to what SolarisBank does as a BaaS provider, you can check out their YouTube self-introduction.

Their functionality includes:

- Digital Banking. This service is fully branded, licensed, and customizable as well as includes a wide range of features.

- Branded card issuing.

- Payment splitting & paperless loans for individuals and SMEs.

- Account Pooling (IBANs included).

- KYC & Bankident features. The process of identification is fully compliant with EU anti-money laundering & privacy regulations.

- Digital assets. SolarisBank offers to create a digital asset platform that is sort of unique to the market.

Additionally, they've recently launched a new solution called Splitpay. Basically, it's the "buy-now-pay-later" feature that's intended to allow companies to offer split payments right in their solutions at one tap or click.

What's unique about this feature is that SolarisBank enables installments for both new purchases and old ones. For example, if an emergency situation happens and, to cover the consequences, a user needs money immediately, but in this way, they won't be able to pay for the remaining payouts, they can divide them as well.

In fact, SolarisBank is one of the most widely used BaaS providers and that’s for a good reason:

- They have B2B2X, meaning that their services can be delivered to an unlimited number of end-users.

- REST API. Such a system implies that their API is fully customizable, separates user interface and data storages (improving portability and scalability), allows caching data (save users data for further use), layering the process which helps the system to work seamlessly.

- They have their own license with a lot of security (KYC) features to offer their customers.

- Flexible, personalized, and transparent pricing policy, meaning that the price strictly depends on the amount of work with no fixed price tags. You can learn more about it here.

As for the drawbacks, you can’t really give it a try since there’s no free trial.

Follow the link to explore SolarisBank API docs.

To start working with them, you simply need to fill out the survey, describing your business, and leaving contact information, thereafter, the SolarisBank team will contact you with instructions for further communication.

# 3: Railsbank 🛤️

Railsbank is a London-based fintech company that allows customers to create their own fintech products that require banking capabilities or to integrate these capabilities into their businesses’ systems.

Railsbank is one of top BaaS providers (shot from Railsbank)

In terms of their functionality, it covers digital banking, crediting, card issuing, financial operations, and data provision. Let’s take a closer look at some of them:

- Digital Banking. Railsbank offers to open ledgers (digital bank accounts from their partners) in GBP, SGD, USD, and EUR.

- Financial operations include sending, receiving, converting (all G10 currencies, debiting accounts, and, naturally, paying with the ledgers. The functionality of these features is quite wide, you can learn more about it here.

- Railsbank offers to issue Mastercard cards in just a few calls.

- Crediting. Railbank enables you to launch credit cards.

- You can also monitor all transactions to prevent fraud, money laundering, etc.

In terms of their strengths, Railsbank's core business is fintech services related to financial transactions — they have a wide range of automation, monitoring, and diversification features for such purposes.

However, even though the currency options are wide, they’re limited which might cause certain inconveniences if you want to work with the ones that aren’t on the list.

If you’d like to learn more about their API documentation, follow the link.

RailsBank offers a guideline on how to get started. So, if we summarize the steps, you should:

- Fill out the Railsbank Application.

- Request API keys & save them after receiving.

- Give access to the account to whoever you need to.

- Choose your details aka customer ID.

- Have a demo presentation.

# 4: Treezor 🌳

Treezor is a European BaaS provider based in Paris that covers all payment chain Fintech services “from issuing to acquiring”. It’s an approved MasterCard® Prepaid supplier.

Treezor is the BaaS provider for FinTech (shot from Treezor)

In terms of Treezor’s functionality, it covers a wide range of fintech services:

- Digital Banking. In this sphere, they offer personalized card issuing with IBAN numbers, e-Walleting, account management, etc.

- Online acquiring. The acquisition includes one-click, by subscription payment models, strong anti-fraud tools, remote contract signing, personalized pricing, regulatory compliance.

- Single Euro Payments Area (SEPA). Basically, Treezor is connected to the SEPA network which makes euro transactions more beneficial as costs are reduced. International transactions within this area are considered domestic (allowing to avoid additional fees and making the trade easier in general). For more info, go on Treezor’s SEPA Payments page.

- KYC & Compliance. They provide white-label identification services for remote account opening that includes KYC, KYB tools, manual as well as automatic analyses, PEP (Politically Exposed Person) & Sanction lists check-ups, anti-fraud management, etc.

- Marketplace & Crowdfunding. They offer a fully managed solution including sending/receiving cash flows, high-level security for users’ funds, fraud management.

Treezor is one of the best European BaaS providers in financial transactions- and risk-management due to their strong security and multi-currency fast payments.

What’s important to remember is that their focus is on the financial infrastructure rather than branding. Even though they enable customized card issuing, it’s not their core business.

For API documentation, follow this link.

To start your partnership with Treezor, you should email them with the “Commercial partnership” motif so they’ll give you clear instructions on their Contact Us page, which would be our # 1 recommendation.

But in fact, it’s not that hard since you simply have to request credentials by adding the

module, setting the API with it afterward.

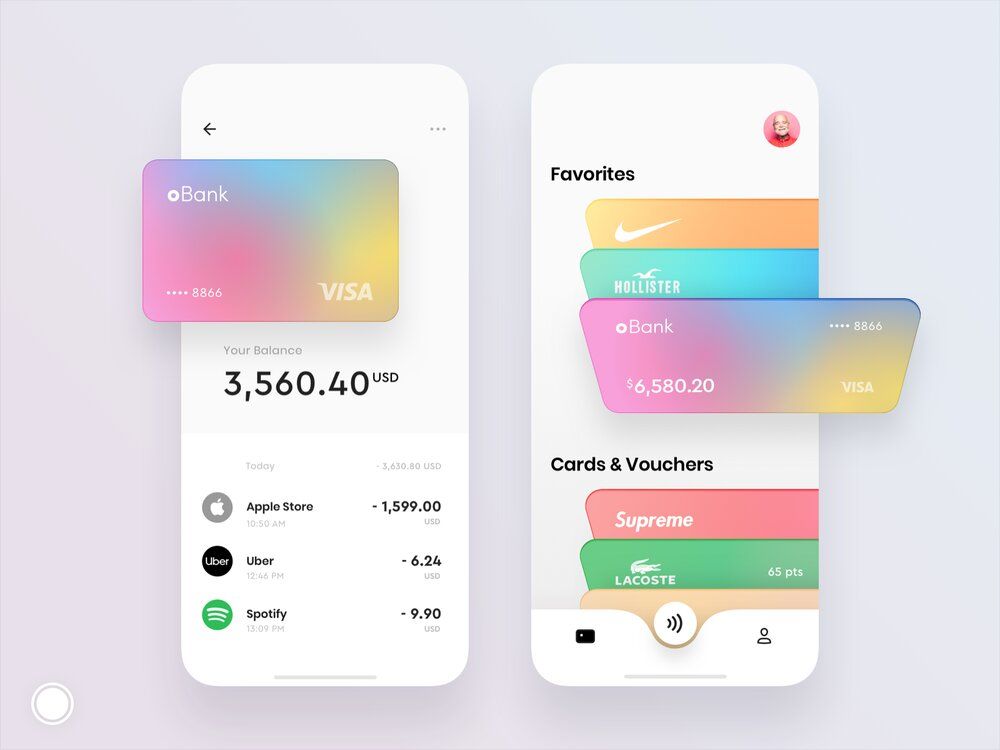

# 5: Marqeta >>

Marqeta is a US-based BaaS provider with branches all over the world, working with fintech and other businesses in the fields of e-Commerce, digital banking, lending, on-demand services, etc.

Their core business is card issuing and payments, however, the features cover quite a wide range of use-cases:

- Fully branded card issuing (debit, credit, prepaid - physical, virtual, tokenized) & transaction processing.

- Accounts funding.

- Production date and personalized insights.

- Incentives and rewards. The name speaks for itself — customers get bonuses for using your cards which improves loyalty.

- Online traveling. They allow travel companies to digitally pay to all third-party tourism-related services with no pre-funding required.

- Lending for small businesses.

- Expense management platform.

- Point-of-sale (POS) enabling — At the “point of sale”, the trader calculates the amount of money owed by the customer for the purchase, indicates this amount, and can prepare an invoice for the customer as well as offer different options for the payment.

As you can see, Marqeta has an extremely wide range of services, that additionally cover use-cases for media & AD agencies, insurance companies, marketplaces, and on-demand services, which is definitely a strength.

Besides, they pay a lot of attention to branding and loyalty improvement. So, if you need a strong branding side, Marqeta might be a great option for this purpose.

However, it might be a little pricier than other players since the US market is generally more expensive.

You can find all API docs on this page.

To start working with Marqeta, you should:

- Create an account.

- Get a card product token.

- Fund a created account.

- Make a $10 transaction for activation.

💡 Takeaways

We’d say that the most important part of choosing a BaaS provider is that there’s no such a thing as “good” or “bad” — all providers listed here are trustworthy, user-friendly, and are used by millions of people.

However, one can suit your specific use case better than other ones. For instance, if you need a highlight on branding and loyalty, take a look at Marqeta. But if you’re sure that all your target audience is in the eurozone, Treezor can offer you more favorable transaction conditions, compared to other ones.

If you need any help with figuring out the right Tech Stack for your use case & developing it, feel free to reach out to us. We know how to help you!

Our clients say

![Stormotion client Max Scheidlock, Product Manager from [object Object]](/static/33294af91c38256bcd5a780ddc41861a/b0e74/max.png)

They understand what it takes to be a great service provider, prioritizing our success over money. I think their approach to addressing ambiguity is their biggest strength. It definitely sets them apart from other remote developers.

Max Scheidlock, Product Manager

HUMANOO

Was it helpful?

Read also