How to Make a Pitch Deck: Examples & Detailed Slides Review

Published: November 8, 2023

23 min read

In this article, you'll learn:

1

🧩 Key Slides to Add to your Pitch Deck

2

📌 Do’s and Don’ts in Your Pitch Deck

3

📢 How to Keep the Investors’ Attention

4

🗂 Successful Pitch Decks

5

💡 Takeaways

Also known as a startup deck, a pitch deck is a presentation that founders show to investors when seeking a round of financing.

Unlike many think, the purpose of a good pitch deck is not about convincing investors that they should support your project. Instead, it needs to show why potential funding partners should want to learn more about it. It’s rather about giving a spark to a long-term relationship than closing a sales deal right here and right now.

It’s also important to distinguish between customer and investor pitching.

In the first case, you’re taking your product up front, focusing on customer needs and how you’re going to satisfy them. Usually, customers don’t really care about your team, revenue model, or marketing and sales strategy.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/5ef38ac1073b4fedb76d346bf1552b0eab05a9f6-1600x1200.jpg?w=1600&h=1200&auto=format)

Don’t mess up the customer and investor pitch deck! (image by Sanmi Ibitoye)

When pitching to potential investors, your company and team are as important to them as the solution, or even more. A good idea can easily fail in the hands of a weak team. Yet, if you can clearly explain what sets your startup apart from others and help you raise funding. This is especially true for Pre-Seed startups as they are relatively young and don’t have much to show in terms of traction.

In this guide, we are focusing mainly on tips & tricks of creating a startup pitch deck for pre-Seed, Seed, and Series A stages. Our goal is to make it clear: what to put and how to put it in your pitch presentation. Ready? Let’s start by breaking down the structure of the slides!

🧩 Key Slides to Add to your Pitch Deck

There are different opinions on the size of your pitch deck. One of the most popular approaches is the “10/20/30 rule” by Guy Kawasaki: you need just 10 slides, the pitch itself should be no longer than 20 minutes and you shouldn’t use fonts smaller than 30 point.

Yet, don’t focus on numbers too much. According to the STORY’s study of 100 pitch decks, the average size of successful decks is 14-15 slides.

The pitch deck outline (or order of slides) is also not strictly fixed. The best advice here is that you have to adjust it to your story so the deck looks consistent both emotionally and logically. If you’re looking for some inspiration, a more or less common pitch deck structure is:

🗃 Section | 📑 Slides | ✏️ Description | |

|---|---|---|---|

Introduction | Title | The very beginning of your pitch deck. Apart from the startup’s name, you can put your motto or social proof here to make it stand out. | |

Product | Problem | A group of slides that reveal your target audience and their problem and explain how your product will address them. | |

Opportunity | Market | Highlight the opportunity by providing data on your market & niche. Here you can also validate your startup’s viability by revealing traction. | |

People | Team | Team is one of the slides where investors spend the most time. It’s a good place not only to introduce who’s working on the project but to point out what makes you different from other teams. | |

Growth | Business Model | This part of the pitch deck is about financial data: how you’re making money now and how you plan on making it in the future; how you’re going to use raised funds. | |

Wrapping Up | Thank you & Contact | Closing part with contacts so that potential funding partners can easily reach you. | |

Let’s take a closer look at best practices on how you can organize each slide!

Title Slide 👋

The Title slide may seem like a piece of cake. Yet, even such a “simple” slide can be designed in a few different ways.

Actually, the only must-have part of the slide is the title and logo of your startup. This approach was used by companies like Mixpanel and Buffer, and worked out well for them.

Buffer pitch deck example with a minimalist title slide

Indeed, placing just a logo can be visually striking. However, many startups prefer to say a bit more on their Title slide by adding:

- Value proposition. Just like Airbnb did with their tagline “Book rooms with locals, rather than hotels”.

- Visuals of your product or/and photos of your customers. For example, on Peloton’s Title slide you can see a happy customer using their bicycle.

- Social proof in form of client/partner logos. In their Series-B pitch deck, Contently placed logos of their top customers to establish trust starting with the 1st slide.

- Contact details. Even though contact details can usually be found on the last slide, some companies like Smart Host also bring them up front. Thus, if someone wants to contact you later, they won’t have to scroll down the whole presentation until the end.

Problem Slide ⛔️

As you probably know, great startups are built around great problems. Thus, it’s one of the key slides for many investors to understand whether your idea is viable at all. This is especially true for early-stage rounds, when startups may not have enough traction to prove that the product is already viable.

The two most common approaches to present the problem are either through storytelling or big data.

The storytelling approach is based on “humanizing” the problem through some real-life or close-to-real-life stories of your target audience. It helps investors to get emotionally involved, especially if they have experienced the same problem in the past or have professional expertise in the given field (e.g. healthcare problems for investors with a medical background).

If you’re looking for startup pitch deck examples with a sole storytelling approach, take a look at MatchBox’s one (a.k.a. Tinder)

On the other hand, big data enables translating the problem into the language of numbers and statistics. In other words, it can demonstrate how many people have this problem, how expensive it is to solve it now, or how much money is lost due to it.

The important thing here is that these two approaches don’t contradict each other. Even though some startups prefer to stick to solely one, as Tinder did, many companies combine storytelling and big data. Thus, they bring to the table both empathy and proven facts. For example, in their pitch deck, Revolut describes online transactions as inconvenient and provides stats on loss due to fees & spreads.

However, no matter what approach you choose, it’s important to show that the problem is really worth taking care of. To emphasize this, try to show it from different angles:

🚨Urgent | 🔒Mandatory | 👥Popular |

📈Growing | 💰Expensive | 🔁Frequent |

Solution Slide ✅

When talking about solutions, startups often focus on features and explain how their product works. However, a better strategy here is to show how your solution addresses the pain points mentioned in the previous section.

Thus, talk first about how your product adds value to potential customers. If you already have some early users, show how your product is changing their lives — real stories always sound more credible than assumptions.

Also, it’s important to prove that your solution is so good that users are really willing to use it. To put it another way, show that your product is a painkiller and not just a vitamin. The painkiller deals with an unsolved problem, whereas a vitamin is just a supplement for an existing solution, a nice-to-have option, but not vital.

Product Slide 📱

This is the right place to tell more about your product itself and how it works, looks, and feels. Don’t confuse it with the roadmap and include only those features that you have already implemented.

Castle’s presentation can be used as a pitch deck template when it comes to the Product slide

It’s also nice to show your product, not just describe. If you already have something live, include a demo or show a video of how your product is used. If not, mockups and images are still better than words when it comes to describing your product.

You can also mention your tech stack but don’t go into too many specifics. Instead of focusing on details that only investors with a solid tech background will understand, highlight those development decisions that add clear value to your startup. For example, if you’re pitching a FinTech product, used technologies can help you explain how you’ve managed to achieve 5x faster or 2x cheaper transactions.

Market Slide 🏬

Hitting the right market is almost as important as developing a great product for it — otherwise it wouldn’t be a part of the Product-Market Fit (PMF).

Potential investors are interested not only in the current market size. For example, they’d also like to know how crowded with competition it is or whether it grows fast enough — these are the questions you need to answer in your pitch deck.

In their own pitch deck, Farewill focus on an obtainable market and don’t do the popular mistake of trying to conquer it all

The truth is that no one knows for sure what the market will look like in 5-7 years. New regulations, political or economic shifts, pandemics, innovative technologies, you name it — anything can dramatically change the market just in a few years. For example, back in 2019, an eLearning market size was estimated to reach $238 billion by 2024. Yet, the COVID-19 pandemic changed the game and in 2021 the eLearning market was already estimated to reach $368 billion by 2024.

With this being said, it’s still important to show potential investors that the target market has a big enough customer base that can pay for your product. There are two ways to calculate the market size:

⬇️ Top-Down Sizing | ⬆️ Bottom-Up Sizing |

|---|---|

Estimating a market’s value based on data from open and closed sources — market research, analytics, and statistics from Gartner, Statista, etc. | Proving a market that you can really seize. For this, you need to define your product price and multiply it by the estimated number of prospective customers. |

“The global market for eLearning is estimated at $250.8 Billion in 2020. We want to capture 4% of the market by 2022. Thus, we’re targeting a $7.5 Billion market opportunity” | “We’re building an employee onboarding platform for startups, SMEs, and corporations with 50+ employees. We’re going to target the EU market, starting from Spain. There are around 26,000 companies in Spain matching our criteria that employ roughly 8 million people. With the average selling price at $35 per month per 50 employees, we’re targeting a $57.6 million market with the possibility to expand in other countries of the EU” |

As you may guess, it’s much easier to gather information for the top-down sizing. Yet, the bottom-up approach provides potential investors with much more realistic and predictable estimates.

The Market slide is often presented using the TAM/SAM/SOM concepts:

- Total Available Market (TAM) describes the size of the total market. This represents the total demand for the product or service, including wide geographic areas and potential customers that yet may be mildly interested in it. For example, it can be the global eLearning market.

- Serviceable Available Market (SAM) describes the market segment that you’re targeting with your service or product. This is a share of the TAM that is usually more geographically localized and narrowed down to the field of your expertise. An example of SAM would be the Online Language Learning market in the EU, which is a part of the global eLearning market.

- Serviceable Obtainable Market (SOM) describes the portion of the SAM that you could actually capture; it’s your real market opportunity as of now. For this, you need to take into account given limitations like competition, sales channels, location, team capacity, technical capabilities, etc. Thus, based on previous examples, your SOM may look like capturing 7-10% of the Online Language Learning market in the EU, including 15-20% of the EU’s online ESL (English-as-a-second language) learning market.

The main idea here is that you need to show two things. First, the target market is big enough and actively growing to make potential funding partners interested. Second, try to be realistic as it’s important for investors to understand what share of the market you can realistically claim.

Unfair Advantage Slide 💪

This slide should emphasize your specialness. However, it’s not about telling how great you, your product, or your team is. There are many great teams and products in the world, yet, not all of them manage to succeed.

An unfair advantage is a card up your sleeve that will help you grow fast. What can it be? Investors tend to look for unfair advantages in the following categories:

🦸♂️ Founder or team | Founders or team members themselves can be considered an unfair advantage when they have exceptional domain expertise & experience in the chosen industry. If you’re one of the top 20 people who are super qualified to solve this problem, it’ll be a really good sign for investors. | ||

📱 Product | The product itself can also be an unfair advantage. When? When it’s 5-10 times better (e.g. faster or cheaper) than what your competitors offer. | ||

📈 Market | Apart from the target market size itself, it’s a green flag for investors when the market has more than 10% of year-over-year (YOY) growth. | ||

🧑💻 Acquisition Cost | The cheaper it is for you to get a new customer, the easier & faster you can conquer the target market. Ideally, it costs you nothing as you get new clients from word-of-mouth marketing. | ||

🏆 Monopoly | It’s possible that your startup enters the “winner takes it all” market. This means that it becomes even more difficult to compete with you as you grow. Think of Uber, YouTube, or Netflix — even though they have competitors, it’s very difficult to compete with them, especially for small startups. | ||

Traction Slide 📊

Before financing your project, investors and venture capitalists will ask you to validate the concept, which means showing traction. Basically, you need to prove that people are willing to pay for your solution to their problem.

It’s quite easy to do when you already have some money in the door: paid pre-orders, sales, or revenues. Thus, you just put this information on the slide, proving that the proposed product roll out is real and achievable. This type of traction is called direct & paid.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/19182711ff2497e03d0e3ed238d4e1da56297c35-1600x1200.jpg?w=1600&h=1200&auto=format)

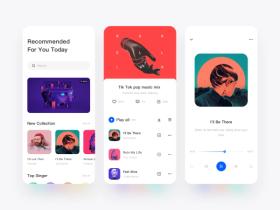

In the best pitch decks, a lot of attention is dedicated to a traction slide (image by Dwinawan)

Yet, as an early-stage startup, you may have no real customers that are already paying you. Does it mean you have no traction? Not really. Instead, you may present to investors direct & unpaid traction — beta subscriptions, letters of intent, website visits, unpaid pre-orders, etc. This will prove that you already have some customer attention and interest even though it’s not yet converted into financials.

Let’s take one more step back. Maybe you don’t have an MVP as you’re just working on it. Therefore, there’s no direct traction (whether paid or unpaid) you can show to investors. Don’t give up because there’s still something you can use to prove your model — indirect traction.

Indirect quantitative traction | Indirect qualitative traction |

Statistics from open sources, polls, market research — anything that can prove that there’s an audience suffering from the problem you’re about to solve is better than nothing. | This includes customer interviews, focus groups, testimonials from potential customers. Despite it’s not as convincing as direct traction, at least it shows that you try to de-risk the investments of your potential funding partners as much as you can at your current stage. |

Apart from the mentioned data, the Traction slides may include:

- Month-over-month growth (MoM).

- Monthly active users (MAU).

- Monthly recurring revenue (MRR).

- Customer lifetime value (CLV).

Finally, be never satisfied with your traction. Always strive for more — and show it to potential investors. Your current traction should be a basement to prove that you can really follow the growth trajectory that you demonstrate during your pitch.

Competition Slide 🏆

The Competition slide may look like a piece of cake. Usually, startups just pick a few direct competitors, put them on a power grid table or a two-axis chart, and compare the products. No surprise, but the startup’s product is always faster, cheaper, more user-friendly, etc. Yet, it may not be the best approach.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/68e6ff4f4831039f26319d6ceb5ca7dda48a900e-1600x1200.jpg?w=1600&h=1200&auto=format)

In your own pitch deck, instead of downplaying your competitors, focus on showing your difference (image by Alex Chizh)

Some of the most common mistakes teams do when preparing the Competition slide in a pitch presentation are:

- Putting features first

As it’s relatively easy to break down each product into a set of features, many startups are tempted to do so. However, the sum of features doesn’t equate to the product and often can’t tell whether product A is better than product B just because it has more features.

Customers buy solutions, so entering the market at an appropriate moment, your marketing strategy, and the efforts of your support service may play a bigger role than features themselves.

- Overlooking indirect competition

Indirect competitors are more difficult to spot and, thus, it seems that they’re less of a danger. However, frequently they are the ones that can make things very difficult for you.

Visible indirect competitors offer a similar product but in another geographic market or for another market segment. If you’re developing a music streaming app for a market that Spotify hasn’t yet entered, at any point it may decide to expand and become your direct competitor in a matter of weeks.

Hidden indirect competitors serve the same customer but with different products. These are usually large companies that have enough resources to break into the target market with a similar product. For example, it was difficult to see Apple as a Netflix competitor until it launched the Apple TV+ service. Similarly, Uber hadn’t been considered a player within the food delivery market until the company had launched the Uber Eats platform.

Typically, startups present a graph with your market position or a comparison table with your and your competitors’ characteristics. These are two classic methods –– Magic Quadrant and Power Grid (or Smart Grid).

However, we prefer a new competitive analysis method created by VC investor Yair Reem –– a Friend or Foe map. As axes, he uses “Market overlap” (target customer or geography) and “Solution overlap” (similarity of products and solutions). This approach not only helps to position yourself in the market but also suggests the best strategy to interact with other players.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/b7d0c29406ea047489732000f300f50736f86167-1920x1080.jpg?w=1920&h=1080&auto=format)

The Friend or Foe map reinvents the "classic" approach to a competitor mapping in pitch decks (image by Yair Reem)

This is how we get four categories:

🤝Partner | 🎯Threat |

👁Observe/Engage | 🚨Risk |

Anyway, whatever approach to competitor mapping you choose, it should be grounded in a solid analysis. As we don’t really appreciate solely feature-based comparisons, we’d suggest you consider the following aspect when making competitor analysis:

- Target Audience — markets and customers (both from the geographic, business, and demographic perspectives) the company is targeting.

- Functionality — features the product offers to users and what pain points it addresses.

- Advantages — strong points your competitor has beyond the product itself (like good pricing, strong marketing, monopoly position on the market, etc.).

- Distribution Model — the go-to-market approach.

- Team — the size of the team and their unique expertise as a team.

A good analysis won’t be fast and easy to do but it will create a solid ground for further competitor mapping.

Team Slide 🤝

It’s the second most important slide for investors –– DocSend research showed that potential funding partners spend around 23 seconds on the Team Slide, almost as long as on the Financial Slide.

Here you talk about your C-levels and key team members. First of all, investors expect to see your track record that will strengthen the image of your team and prove your capabilities. The main thing here is that all the experience, achievements, and career highlights should be relevant to the startup’s chosen industry.

In their slide deck, Alan provides a full picture of their team and their experiences

It’s quite difficult to say what exactly you should put on this slide except for your titles, pictures, and short bios. Yet, the STORY’s study of 30 investor opinions on the Team Slide revealed key characteristics that they’re looking for in startup teams. Thus, it may benefit you if you focus on showing the following qualities:

- passion towards the industry;

- success-oriented mindset;

- resilience;

- good relations within the team;

- diverse backgrounds, talents, and points-of-view among the team members;

- proven and niche-specific expertise;

- industry connections;

- insider data to technology or industry data.

Finally, don’t forget that investors may not believe in the idea as much as they believe in people. Even Airbnb was financed in the first place not because it seemed like a great project but because Y Combinator’s founder Paul Graham liked the team.

Business Model Slide 💸

This slide is basically your business plan on making money. The details may differ to some extent based on whether you already have some traction or just projections. However, the general structure of the slide usually includes the following elements:

- Monetization model. How are you going to make money? It may be direct selling, subscription-based approach, adverts, fee, etc. If you plan to add or gradually switch to another model, put these intentions on the slide, too.

- Price. Clarify the product or subscription price. However, it’s also important to draw a bigger picture: show how your pricing differs from the competition and fits into the market (whether you’re hitting a premium or a standard segment).

- Sales and distribution model. It’s not enough just to make a great product, it’s necessary to deliver it to the target audience. How are you going to do this? What is your marketing and sales strategy? What paid and unpaid channels are you going to use for promotion and distribution?

- Cost Structure. You need to spend money to make money. Thus, your business model also needs to include your spending — from your office maintenance to marketing expenses based on the customer acquisition cost (CAC).

Actually, there’s no need to reinvent the wheel in terms of what info you should put on this slide — just follow your Lean Canvas. In case you don’t have one yet, it’s the right moment to get it done.

Financials Slide 📈

While the Business Model slide explains how you’re going to make money, the Financials slide goes a bit more into numbers and details. Basically, it’s all about proving that your business model is actually viable.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/a6a081ea9cce24748305f86e5ba916a092d4c9e3-1600x1200.jpg?w=1600&h=1200&auto=format)

After you describe your business model in a slide deck, it’s time to get down to numbers (image by Antoine Plu)

The goal of this slide will differ depending on the fundraising stage you’re at. For pre-Seed startups, it’s mostly about showing realistic financial projections. And Series-A companies are expected to prove how a new funding round will help them rapidly grow, based on their current financial insights.

This slide usually includes the following key points:

Income Statement | Expenses | Business KPIs |

Cash Position | Previous Funding | Projections |

Also, Mike Lingle shared a list of top 5 mistakes teams make when preparing their Financials slide:

- Expenses don’t grow with revenue.

- Headcount doesn’t grow with revenue.

- Revenue per Employee is unrealistic.

- Cost of Sales (COGS) is out of line for the industry.

- The founder is raising too much money relative to the stage of the company and the projected growth.

Finally, be careful with highly-sensitive data — you never know who exactly may see your pitch deck. It may be reasonable to prepare a separate extended financials paper to show to potential investors you trust.

Roadmap Slide 🗺

In this section of the pitch deck, talk about you getting from point A to point B in the next couple of years. It’s not only important to define how you’re going to move but clearly set what your point A and point B are.

Most often, a roadmap is really about new features you’re going to implement, yet, it may be not limited just to it. Entering new markets, expanding geographically, or launching on a new platform — these are the examples of point B you may have.

Yet, when it comes to features, don’t just list all of them. Review the list and group them into logical blocks so you have a sequence that shows how these blocks will help you to capture or defend your market position.

Front’s pitch deck contains a great example of a roadmap with key milestones in different fields (platform expansions, new integrations, features, etc.)

The roadmap is especially essential for the first 18 months of a startup’s existence when you are just looking for PMF and forming a go-to-market strategy. Investors expect to see a clear understanding of the processes and progression of the project so that you get the first strong traction as quickly as possible. With such a tight timeline, any mistake can take months off your runway.

Since potential investors pay a lot of attention to risks and profitability, it’s a good idea to link your milestones to increase in value. If it doesn’t improve your key metrics — think twice before listing it as a milestone.

As a part of the roadmap slide, you may also specify the amount you’re raising and how you’re going to use it to hit the milestones.

Thank you & Contact Slide

Even though it’s the simplest slide, dedicate some time to leave a good lasting impression. As this slide opens the floor to questions during live pitch events, add a thank you note to make it clear. Alternatively, you can put a call to action to encourage investors to get in touch with you.

Apart from the email and phone number, you may also add a website or social media accounts so you can be easily found through different channels.

📌 Do’s and Don’ts in Your Pitch Deck

We’ve already figured out what you should prepare for your ideal pitch deck. Yet, as you probably will be pitching live (no matter whether during an event or tet-a-tet), we wanted to share a few recommendations to make you feel more confident:

Do’s

-

1 slide –– 1 point

If you fill the slide with many points, your audience will have to spend more time absorbing the information and stop listening to you. If you want to tell more, use visual elements like infographics, charts, and images.

-

Find the right investor

Better to search for investors who have experience in your field and, thus, will be more interested in this project.

-

Make realistic financial projections

If in your calculations expenses and headcount don’t grow with revenue, or revenue per employee is too big, this is a red flag for investors.

-

Consider the context

Use a more informative pitch if you send it by email, but less detailed if you present it in person.

-

Create a story

Your pitch deck should be read as a narrative. Don’t throw all the data together; make it a continuous stream of thought. Add emotionality to engage the audience and convey the importance of creating this project.

Don’ts

-

Pretend you know everything

Your product may be better than the competitor’s project, but hardly in every aspect. Don’t demean other companies if they are really better at something.

-

Worry about the look of the pitch deck

An excellent visual is a great way to raise the awareness of the audience. But content is much more important. Fill your pitch deck with content first, because there will be no good project without an idea.

-

Use small fonts

If funding partners have to try hard to read what’s written on your pitch deck, it will reduce their engagement and create a bad impression of you.

-

Use jokes or memes

Everyone has a different sense of humor, so you never know, will your audience understand it or not.

-

Be afraid to hear «no»

If you were rejected, it’s a great chance to review your idea again, understand where you were wrong, improve the project, and continue to seek funding with renewed energy.

📢 How to Keep the Investors’ Attention

Usually, angel investors or venture capitalists see more than 100 pitch decks a year, so they quickly let a project go if they aren’t interested in it from the beginning. To get a potential funding partner to listen all the way through, use these tips:

Be a narrator 💬

Good stories make people listen. Why not use storytelling in your pitch to keep the attention of your partners? Stories are easier to comprehend than dry numbers and facts, they are remembered faster, and create an emotional connection.

Become a narrator who talks about your ideas, employees, competitors, and smoothly leads up to a vision of your business a year from now. Your story should be like a book –– with action, confrontation, (bad) luck, and lots of detail to keep people listening to you throughout the pitch.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/4c84bc2353e16ffb0b95b8805080ce299ab031b0-1600x1200.jpg?w=1600&h=1200&auto=format)

Apart from making a great pitch deck, create a compelling story about your product, customers, team, or the problem you solve (image by Diana Traykov)

Find the main character. It could be you with your story of creating the project or your client with a problem solved thanks to your startup. If you don’t want to look for a protagonist, reveal your uniqueness in the field which you’re trying to enter.

Pitch storytelling is good because it takes an investor on a journey. Storytelling makes people get into your character, feel connected with you, and increases the chances of successful financing.

Keep it short and simple ⚡️

Although you’re probably proud of your project and want investors to know everything about it, it’s better to shorten your pitch. Give investors less information and leave room for questions.

Your pitch deck should be short and clear –– then it’ll be easier to understand. Look at successful startups: Airbnb’s first pitch deck took only 14 slides!

Imagine each section of your pitch in good old Twitter with its 280-character limit (or better yet, 140). That’s about how you should fill a slide with text. If you realize that’s not enough to cover the topic, explain everything missing verbally, but don’t go beyond the general 20-minute limit either.

Eye contact is important 👁

Building and maintaining communication is an essential part of any presentation. Think back to your high school teachers who used to look you in the eye repeatedly. Sometimes that was the only thing that could make students pay attention to a speech and begin to perceive it.

{ rel="nofollow" target="_blank" .default-md}*)](https://cdn.sanity.io/images/ordgikwe/production/73e53d7f8a15103ae93bdda6ff76a02f3dbbc70d-1600x1200.jpg?w=1600&h=1200&auto=format)

Your success depends not only on the pitch deck itself but also on how you manage to present it (image by Unini)

It’s the same with the audience: if you talk to people and at least make eye contact for two-way communication, they stop ignoring you. The ideal length of eye contact is three to five seconds. If you have only a few people listening, make contact with all of them.

Alternatively, if you’re presenting your product to about 20 investors, pick five people at different points in the room to look at. It will work with everyone: while you’re moving your gaze from one to the other, people think you’re looking at them. As long as you are focusing on a particular person, everyone sitting next to him will also think you are communicating specifically to them.

Use visual elements 🎨

Visual information is processed by the brain faster than text, so don’t forget to use statistics, infographics, product demonstration videos, etc. Infographics make it easier to explain complex concepts, display numerical data, and show the best sides of your product.

Another plus of visual elements is that you can use them in your social networks. So if you make a great infographic with interesting data, you can post it on LinkedIn and get a great response.

Be careful with screenshots as they can stretch out and become completely unreadable when you open the pitch deck on a big screen. Also, don’t use small print –– not everyone has good eyesight.

🗂 Successful Pitch Decks

Preparing a pitch deck can be frightening if you’ve just started a company or have never done fundraising. To give you an idea of what a good pitch deck should look like, we’ve prepared two examples from well-known startups.

🚕 Uber’s first pitch deck

Uber is the most famous online taxi service with more than 90 million users worldwide. In 2008 the company got a $200 thousand investment, which helped it reach the top of the market.

Being one of the most famous pitch decks, Uber’s presentation can still be a source of inspiration to many

The original Uber idea is different from today’s, but even now, this presentation is a good example of a pitch deck:

- Describes the current cab market in 2008.

- A clearly defined problem (inefficiency) concept (higher-end rides).

- Key advantage –– membership only.

- Other differences: digital-hail (1-Click hailing), fast response, luxury cars.

- Have environmental benefits.

- Provide market statistics by segment.

- Additional statistics on the use of smartphones in different regions –– Uber team determined why they focus on RIM OS (Blackberry).

- Different success scenarios.

- Progress at the time of fundraising.

- Roadmap –– new cities and optimization.

📩 Yalochat’s 2019 pitch deck

Yalochat is an AI-based CRM that helps companies to interact with their clients in commerce on messaging apps. This startup fundraised $8 million in Series A.

Front’s pitch deck contains a great example of a roadmap with key milestones in different fields (platform expansions, new integrations, features, etc.)

Back in 2019, the company managed to raise $8 million in Series A funding with this pitch deck.

Here are good points from the Yalochat pitch deck that you could use in your presentation:

- Concision –– pitch deck should be accompanied by explanations.

- Visualization: a lot of numbers and statistics.

- Use of own market research in addition to data from other publications.

- Show traction (MoM growth).

- Understand that they have many competitors.

- Key employees with experience in machine learning and messaging space.

💡 Takeaways

Every business is unique, so there’s no one-size-fits-all advice on exactly how to make a selling pitch deck. But you can improve your chances if you follow our tips:

- Tell a unique story. It can give much more than dry facts.

- Practice your pitch every day on someone you know. This practice will make it easier to establish eye contact during presentations.

- Don’t overdo. Use several slides with a limited amount of text.

- Be sure to leave contacts at the end of the pitch deck.

- Failure is also an experience. Find out what your gaps are and move on.

A great pitch deck can reduce your time to find the right funding partner and get support.

Also, be sure to check our extended guide on (Pre-)Seed Funding:

If you need an experienced tech-partner, who knows how to make a good round and develop your MVP, feel free to contact us. We would be happy to support your project!

Was it helpful?

Read also

Stormotion's ChatGPT Journey

Top 5 Best Practices for Integrating ChatGPT in Your App

How to Build SaaS App Like Spotify

Our clients say

![Stormotion client David Lesser, CEO from [object Object]](/static/93e047dadd367691c604d8ffd1f54b58/b0e74/david.png)

They were a delight to work with. And they delivered the product we wanted. Stormotion fostered an enjoyable work atmosphere and focused on delivering a bug-free solution.

David Lesser, CEO

Numina