The healthcare industry is evolving rapidly, and mobile technology is at the forefront of digital transformation. Managing your health insurance from your hand is no longer a distant vision. Today, users can easily choose the right plan, submit claims, track expenses, and even find the nearest doctor — all through a single mobile app.

With consumers expecting more digital convenience, it's no surprise that health insurance providers, healthcare institutions, and health tech startups are increasingly investing in health insurance app development to stay competitive.

But how do you build a health insurance app that meets all the needs of your clients? The process, while intricate, can be broken down into a few clear steps:

- Research: Start by identifying market needs and understanding what your users expect from a health insurance app.

- Discovery Phase: Define the app’s key features and create a development roadmap tailored to your goals.

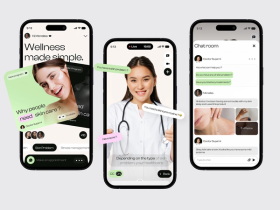

- UI/UX Design: Focus on creating a user-friendly interface that is both intuitive and visually appealing.

- Development: This is where your app comes to life, as developers code the core functionalities.

- Compliance Checks: Ensure your app meets healthcare regulations like HIPAA to protect user data.

- Testing: Rigorously test the app to identify and resolve any issues before launch.

- Launch: Deploy your app to the market, making it available to users on iOS, Android, or both.

- Post-Launch Maintenance: Continuously improve your app based on user feedback and performance analytics.

Curious about the details of each health insurance mobile app development step?

If you have time to discover all the intricacies of the health insurance app market, keep reading the article.

🏥 Health Insurance Apps Market Overview

As demand for digital health solutions rises, understanding the health insurance app market is crucial. Businesses from healthcare providers to tech startups are leveraging these apps to enhance customer experiences and streamline operations.

Statista reports that the health insurance market is projected to grow to $2.38 trillion in 2024, with an average spending of $306.7 per capita. The market is expected to continue growing at a CAGR of 2.43% from 2024 to 2028, reaching approximately $2.62 trillion.

The global health insurance market is experiencing consistent growth worldwide (image by Statista)

In global comparisons, the United States leads the health insurance market, expected to hit $1.71 trillion in 2024, with an average per capita expenditure of $4,700. According to Statista, the United States market is projected to grow at a CAGR of 3.07% from 2024 to 2028, resulting in around $1.93 trillion by 2028.

But what are the key drivers of rapid growth in health insurance application development? Let’s find out in the next section!

❓ Why Is There a Growing Demand for Health Insurance App Development?

The demand for health insurance app development is driven by several key factors.

Key Drivers | Explanation |

|---|---|

Aging Population | As the global population ages, the need for health insurance services grows, prompting providers to develop user-friendly digital solutions tailored to older adults. |

Competitive Advantage | Offering a user-friendly mobile application can differentiate insurance providers in a crowded market, attracting tech-savvy customers and retaining existing ones. |

Increased Focus on Preventive Care | The emphasis on preventive care is rising, and health insurance apps facilitate this shift by providing tools to track health metrics and access essential resources for proactive health management. |

Regulatory Changes | Changes in healthcare regulations worldwide encourage providers to engage in medical insurance app development that enhances compliance and streamlines reporting, ensuring they meet evolving requirements. |

Customer Preferences and Market Trends | According to Statista, consumers are seeking comprehensive insurance coverage that includes specialized treatments and wellness programs, highlighting the demand for personalized insurance plans and convenient access to healthcare through innovative apps. |

📌 Together, these factors underscore the urgent need for health insurance apps that allow providers to enhance customer engagement and adapt to a rapidly evolving marketplace.

💊 Benefits of Health Insurance App Development

But what are the specific benefits of investing in health insurance app development? Let’s explore how these apps can transform the way providers and consumers interact.

Advantages of Health Insurance Mobile App Development

- Convenience and Accessibility. Health insurance apps provide users with easy access to their insurance information and healthcare services anytime, anywhere, enhancing the overall user experience.

- Streamlined Communication. These apps facilitate direct communication between providers and users, reducing response times and improving service quality.

- Real-Time Information. Users can access real-time updates on claims, coverage details, and policy changes, keeping them informed and empowered.

- Single Point of Data Storage. Centralizing all health insurance information in one mobile health consumer app simplifies management for users and providers, improving efficiency.

- Minimized Paperwork. Digital solutions reduce the need for physical documents, making it easier to manage records and ensuring a more sustainable approach.

- Advanced Navigation System. Intuitive navigation features help app users easily find the information they need, enhancing overall satisfaction with the app.

- Enhanced Productivity. Automating processes through the app allows providers to focus on delivering quality care, increasing operational efficiency.

- Revenue Maximization. By improving customer engagement and streamlining operations, health insurance apps can drive higher revenues for providers through increased policy uptake and customer retention.

📌 Overall, the decision to create a health insurance app can not only enhance user experience but also drive operational efficiency and revenue growth for providers in a competitive market.

⚙️ Key Features of a Health Insurance Mobile Application

While the benefits of mobile health insurance apps are clear, what specific features should these applications include to meet user needs effectively? Let’s dive into the essential functionalities that can enhance user experience and streamline operations.

User Profile

A user profile is essential for storing personal insurance and health information, medical history, and coverage details. It allows users to manage their accounts, view policy information, and track claims in one place.

Choose the Best Health Insurance Plans

When you make a health insurance app, you should give users the ability to compare health insurance plans based on premiums, deductibles, and coverage options. Users can make informed decisions tailored to their healthcare needs by providing side-by-side comparisons.

Claims Management

The claims management feature simplifies the process of submitting and tracking claims. Users can easily upload documents and receive real-time updates on their claim status, significantly reducing the time and effort needed to manage reimbursements.

Real-time claim status tracking is a vital feature of medical insurance app development, allowing users to monitor their claims (image by Jack R.)

Payment Management

This feature allows users to track and manage payments, such as premiums, deductibles, and co-pays. It includes reminders, scheduling options, and a detailed transaction history to help users stay on top of their insurance-related finances.

Media Sharing

A media-sharing feature facilitates the sharing of medical documents, images, and receipts between users and insurance providers. This capability streamlines communication and helps expedite the processing of claims and inquiries.

Effective Communication

Incorporating effective communication tools within the app, such as online chats and video/audio calls, enables users to message insurance agents or healthcare providers directly. This ensures quick responses to queries and fosters a better relationship between users and their insurance representatives.

Designing a health insurance app that’s both intuitive and secure is crucial in the healthcare space. Features like real-time updates, AI-driven diagnostics, and seamless claims management aren’t just added conveniences — they’re necessities for providing a smooth user experience while keeping sensitive data safe.

Serhii Ninoshvili, Project Manager @ Stormotion

In-App Payment Integration

If you want to add extra value to your app, you can integrate in-app payment gateways when you build a health insurance mobile app. It enables users to securely make payments directly within the app, without needing external platforms.

Push Notifications

Push notifications serve as real-time alerts to inform users about important updates, such as insurance policy changes, payment reminders, and new services. This feature keeps users engaged and informed about their health insurance status.

Early Diagnosis

By leveraging AI-powered tools, early diagnosis features can analyze health metrics and detect potential issues before they escalate. This proactive approach supports preventive care, empowering users to manage their health more effectively. Additionally, users can find the right doctor based on their specific health concerns, ensuring they receive timely and appropriate care.

You can also incorporate features commonly used to develop a mental health app, such as therapy scheduling, symptom tracking, and guided meditations.

Multi-Factor Authentication

Implementing multi-factor authentication adds an extra layer of security to protect sensitive user data, ensuring compliance with regulations like HIPAA. By requiring additional verification steps, such as biometric scans or one-time codes, this feature enhances overall security and protects against data breaches in healthcare apps.

Searching for Doctors

A searchable directory of healthcare providers allows users to find in-network doctors based on their location and specialty. When you develop a health insurance app or develop womens health app, including this directory can significantly improve user experience and satisfaction.

Integration with telemedicine services in health insurance app development allows users to consult healthcare providers directly through the app (image by Reka Rahayu)

Search for Drugs

A drug lookup tool enables users to search for medications, including their costs and availability at local pharmacies. By leveraging IoT in healthcare, you can also enable smart reminders for taking medications, ensuring patients stay on track with their prescriptions and improving adherence to treatment plans.

Access to Medical Documents

Providing secure access to important medical records within the app allows users to store and retrieve prescriptions, test results, and other essential records easily. This feature promotes organization and ensures users have important information readily available.

Support Team

What apps lack customer support? Those that don’t prioritize user experience and customer loyalty. However, you shouldn’t overlook this feature during health insurance software development. Having a dedicated support team accessible through the app ensures that users can get assistance with technical issues or inquiries related to their insurance.

In summary, key features of health insurance mobile apps are essential for enhancing user experience and engagement. By integrating functionalities like user profiles, claims management, and AI-driven early diagnosis tools, these apps empower users to take control of their health and insurance needs while ensuring data security and compliance.

🩼 Types of Medical Insurance Applications

Now that you’re familiar with the key features of health insurance mobile applications, it's important to explore the different types of apps that cater to the diverse needs of users within the healthcare ecosystem. When you develop a health insurance application, understanding these types can help ensure that you meet user needs effectively.

Let’s take a look at them!

Health Insurance App for Patients

Health insurance apps for patients empower users to manage their health insurance effectively. Oscar Health allows users to view coverage, find in-network providers, and submit insurance claims seamlessly. Similarly, MyIH offers personalized health insights, appointment reminders, and tools for tracking health metrics, encouraging proactive policy management.

User-friendly chatbots in health insurance app development provide instant assistance, improving customer support (image by RonDesignLab)

Want to learn more about doctor appointment app development? Go and read our article!

Health Insurance App for Healthcare Providers

Health insurance applications for healthcare providers enhance communication between healthcare providers and insurers, streamlining claims and improving patient care.

For instance, Zocdoc helps providers manage appointments while sharing critical insurance information in real-time. Effective health insurance app development can further optimize these processes, ensuring that both providers and patients benefit from improved access and efficiency.

Each type of medical insurance app serves a different audience but shares one goal: improving access to healthcare. Whether you’re building for patients, providers, or insurance companies, personalization and ease of use are key to ensuring high user engagement and satisfaction.

Serhii Ninoshvili, Project Manager @ Stormotion

Health Insurance App for Insurance Companies

Health insurance apps for insurance companies serve as comprehensive tools for managing policies and customer interactions. Aetna and Cigna offer platforms for policyholders to review benefits, track claims, and access health resources. Humana and Anthem Inc. also provide user-friendly apps that improve customer satisfaction through analytics and direct communication.

📌 To sum up, each type of healthcare insurance app plays a crucial role in enhancing user experience and fostering better communication across the healthcare ecosystem.

⚒️ How to Build a Health Insurance Mobile App: Main Steps

With a strong foundation in the private health insurance app market and its core features, let’s explore the essential steps for building a successful app. These steps ensure your app meets user needs and complies with industry regulations.

Research

The foundation of any successful health insurance app lies in comprehensive market research. Begin by identifying the needs of your target users — whether they are patients, healthcare providers, or health insurance companies.

Success starts with research. Understanding your target users' needs will shape every decision — from the app's features to its user interface. The discovery phase is where we align stakeholders, ensuring that the app meets business goals, user needs, and technical feasibility while clarifying requirements, scope, and potential challenges before development begins.

Serhii Ninoshvili, Project Manager @ Stormotion

Explore existing solutions offered by competitors like Oscar Health or Aetna to pinpoint their strengths and weaknesses. Conduct surveys, gather user feedback, and analyze trends such as the rise of telemedicine platform development and AI-driven diagnostics. This step ensures your app addresses specific pain points and offers a unique value proposition.

Discovery Phase

In this phase, you'll define the core objectives of your app, establish KPIs, and outline a detailed health insurance mobile app development roadmap. This stage involves creating user personas to understand the behavior and needs of your app’s target audience.

Collaborate with key stakeholders — insurance experts, developers, and designers — to prioritize the most important features. You should also outline technical requirements like the tech stack, integrations (e.g., APIs for claims processing or telehealth platforms), and regulatory compliance measures. Clear documentation from this phase will streamline the development process.

To learn more about the importance of the discovery phase, check out our comprehensive guide, based on our hands-on experience with real projects:

UI/UX Design

User-friendly design is crucial in medical insurance app development, where simplicity and clarity determine the app’s success. Start by creating wireframes to visualize the app’s structure, followed by prototypes that simulate user interactions. Ensure that the app is intuitive, with easy-to-navigate menus, accessible icons, and clear labeling.

A robust search feature in medical insurance app development enables users to find in-network providers quickly (image by RonDesignLab)

Design with accessibility in mind (e.g., larger fonts and voice commands for elderly users). Focus on a seamless user experience, where users can easily view health plans, manage payments, or contact support. Test designs with real users early on to gather feedback and refine accordingly.

This is also true to aged care app development. Voice‑enabled commands, high‑contrast visuals, and easy‑access emergency buttons are must-have features to ensure usability and comfort for elderly users.

For more insights on making your app accessible and inclusive, be sure to explore our detailed guide, written by our React Native developer, Alexander Pokhil:

Development

At this stage, your app’s blueprint comes to life. The health insurance application development process involves both frontend and backend engineering.

- Frontend development focuses on building a responsive interface that works smoothly across devices (iOS, Android, or cross-platform).

- Backend development, on the other hand, involves setting up the infrastructure to handle user data, manage claims, integrate third-party services (such as payment gateways and push notification services), and ensure real-time communication between users and insurers.

Agile development methodologies are ideal, allowing continuous testing and improvements as new features are implemented.

Want to know how we use the Agile approach in our projects? Check out our comprehensive article with PM insights:

Compliance Checks

Ensuring compliance with industry regulations like HIPAA or GDPR is non-negotiable for any mobile health consumer app. Here’s how you can maintain compliance:

- Implement robust encryption and secure data storage from the start.

- Regularly review and update insurance policies to meet evolving regulatory standards.

- Conduct thorough audits of both the app and your development process to catch any vulnerabilities early.

Health insurance app development includes a feature for users to compare different insurance plans side by side (image by 300Mind UI/UX)

Take a look at our comprehensive guide on ensuring that your app is secure and ready to meet the legal requirements of the health insurance industry:

Testing and QA

Testing is a crucial stage of health insurance software development, where the app undergoes rigorous evaluation to ensure all features work as intended.

- Functional Testing. We perform extensive functional testing to ensure that core functionalities like claims management, payments, and notifications operate without glitches.

- Non-Functional Testing. This encompasses several key areas:

- Performance Testing. We ensure the application can handle high traffic.

- Usability Testing. We assess the app's user-friendliness to ensure it meets user expectations.

- Security Testing. We perform testing to identify any vulnerabilities that could compromise sensitive data.

If you're interested in learning more about our QA process, check out the complete guide from our experienced QA Engineer, Ostap Shtypuk:

Launch

Once you build a health insurance mobile app and conduct thorough testing, it’s ready for launch. The process begins with submitting the app to relevant app stores (Google Play, Apple App Store) while ensuring it meets their guidelines for health and medical apps.

Medical insurance app development focuses on providing users with the ability to book doctor appointments easily (image by RonDesignLab)

Simultaneously, create a marketing strategy to raise awareness about your app — leverage digital marketing, email campaigns, and partnerships with healthcare providers.

A well-coordinated launch should include a smooth onboarding process for users, with clear tutorials or guided tours to help them navigate the app and access its key features easily.

Post-Release Maintenance

The journey doesn’t end with the app’s launch. Post-release maintenance is essential to ensure your app remains functional, secure, and up-to-date with the latest technology trends and regulations. Monitor user feedback closely and push updates that address bugs, introduce new features, or enhance performance.

Regular updates also help maintain user engagement and loyalty. For example, adding advanced AI-based health tracking or expanding the app’s telehealth services based on user needs can ensure long-term success.

Curious about how we handle post-release maintenance? Check out our comprehensive article:

By following these steps, you'll make a health insurance app that not only meets industry standards but also delivers real value to your users. Whether it’s streamlining claims, facilitating preventive care, or enhancing patient-provider communication, each step is a vital part of building health insurance software.

⚙️ Tech Stack to Create a Health Insurance Mobile App

With a roadmap in place to create a digital healthcare app, it's crucial to focus on selecting a robust tech stack that ensures scalability and security.

- Use React Native for cross-platform compatibility, enabling you to develop for both iOS and Android simultaneously. For native applications, you may consider Swift for iOS development and Kotlin for Android.

- Utilize Node.js or Laravel for robust server-side development. Express.js can streamline your application framework, allowing for efficient routing and middleware management.

- Choose from MySQL for structured data storage, MongoDB for flexibility, or Redis for fast in-memory data processing.

- Leverage AWS or Vultr for scalable cloud hosting, paired with NGiNX as your web server to manage traffic efficiently.

- Utilize design tools like Figma or Principle to create intuitive user interfaces and enhance the overall user experience.

- Payment gateways such as PayPal and Stripe provide secure and seamless in-app transactions.

📌 By carefully selecting your tech stack, you can create a health insurance app that meets industry standards and enhances user engagement.

💲 How Much Does It Cost to Build a Health Insurance App?

Having discussed the essential features and tech stack for your health insurance app, it’s crucial to understand the associated costs. Developing a health insurance app involves various components that contribute to the overall budget.

The cost to develop a health insurance app typically ranges from $32,610 to $44,810, depending on the complexity of features and the development team's expertise. Here’s a breakdown of the costs and some effective strategies to navigate the financial challenges involved.

Understanding the Cost Components of Developing Health Insurance Apps

To effectively manage your budget, it’s essential to understand the various components associated with the cost to develop a health insurance app.

Cost Components | Explanation |

|---|---|

Software Licensing | Your development project may require third-party software and libraries with varying licensing fees. Be sure to consider both upfront and ongoing costs when planning your budget. |

Implementation and Development Costs | Development costs often include salaries for developers, designers, and project managers, which can significantly impact your budget. To manage these expenses, consider hiring a health insurance app development company, as it’s more cost-effective. |

Infrastructure Costs | Hosting services and database management are essential for your app’s performance and reliability. You can manage these costs by choosing a cloud service provider like AWS or Azure. |

Ongoing Maintenance and Support Costs | Regular updates and bug fixes are vital to ensure your app remains functional and secure. Establish a budget for ongoing support and maintenance, which can include hiring a dedicated support team or continuing the cooperation with your tech partner. |

All these cost components are generally applicable to the development of any healthcare application. You can also consider them to accurately estimate the cost to build a healthcare app like Zocdoc.

Factors that Affect Costs of Building Medical Insurance Apps

Now, Serhii Ninoshvili, our PM Manager, will help us define key factors that can significantly influence the overall cost to develop a medical insurance app.

Development costs can escalate quickly if you don’t prioritize your app’s core functionalities. The complexity of features, scope creep, underestimated integrations, and frequent design changes are major cost drivers. Focusing on what is essential for users rather than nice-to-have features is a crucial budgeting strategy.

Serhii Ninoshvili, Project Manager @ Stormotion

App Type

Different types of health insurance apps — such as those focused on patients, healthcare providers, or insurance companies — come with varying levels of complexity. For instance, an app designed for claims management may require more intricate backend support than a simple user interface for information access.

Platform (iOS, Android, Cross-Platform)

Developing for both iOS and Android typically incurs higher costs due to the need for platform-specific adjustments. Cross-platform frameworks like React Native can reduce the cost to develop a health insurance app by allowing for a single codebase.

Development Cost Factors | Estimated Cost Range |

|---|---|

Platform Choice (cross-platform) | $2,280–$3,130 |

Features and Functionality

The more advanced features your app offers — like claims management, payment integration, user profiles, and early diagnosis capabilities — the higher the development costs. Prioritize features that align with user needs and your business model to avoid unnecessary expenses.

Advanced data analytics in health insurance app development helps users track their health expenses and claims history (image by RonDesignLab)

Development Cost Factors | Estimated Cost Range |

|---|---|

Features and Functionality | $9,100–$12,500 |

UI / UX

The design of your health insurance app plays a crucial role in user experience and satisfaction. Key elements to focus on when you develop a health insurance app include intuitive layouts, clear navigation, accessibility functionality, and responsive design that adapts to various devices.

Development Cost Factors | Estimated Cost Range |

|---|---|

UI / UX Design | $1,520–$2,090 |

Backend Development

The backend handles server-side operations, database interactions, and business logic, enabling smooth communication between the app and the server. A well-structured backend not only supports efficient data processing but also contributes to a seamless user experience by allowing quick access to information and services.

Development Cost Factors | Estimated Cost Range |

|---|---|

Backend Development | $13,640–$18,750 |

Third-Party Integrations

You can integrate your healthcare app with Epic EHR to ensure seamless and efficient health record management. Integrating third-party APIs for functionalities such as payment processing, chat functionality, or data analytics can raise the cost to develop a medical insurance app. However, these integrations can significantly enhance the app’s capabilities, making it more competitive.

The incorporation of wearables in medical insurance app development provides users with real-time health insights (image by Awsmd)

Development Cost Factors | Estimated Cost Range |

|---|---|

Third-Party Integrations | $4,550–$6,250 |

Testing and Quality Assurance

Rigorous testing is essential for any health app, especially considering the sensitive nature of healthcare data. Investing in quality assurance upfront can help avoid costly fixes later.

Development Cost Factors | Estimated Cost Range |

|---|---|

Testing and QA | $1,520–$2,090 |

Maintenance and Updates

Regular maintenance is necessary to keep the app compliant with healthcare regulations and responsive to user needs. Set aside a budget for ongoing maintenance to ensure the app remains functional and aligned with evolving market requirements.

Development Cost Factors | Estimated Cost Range |

|---|---|

Maintenance and Updates | ~33% of the initial development budget per year |

4 Ways to Reduce the Cost of Health Insurance App Development

By employing strategic approaches, you can effectively minimize the development costs while creating a high-quality health insurance app.

Outsource the Development

Consider outsourcing development to regions with lower labor costs while still maintaining high quality. Collaborating with an experienced health insurance app development company can lead to significant savings without compromising the end product development.

Need help building a custom health insurance app? Let’s create it together!

Validate Your Idea

Conduct thorough market research and gather user feedback during the ideation phase. This validation process helps identify the most valued features, allowing you to avoid investing in unwanted functionalities.

Outsourcing health insurance app development to skilled teams in cost-effective regions can save both time and money without compromising on quality. Building an MVP first is another smart way to avoid overspending. It allows you to test the waters and gather user feedback before fully committing to a complete product.

Serhii Ninoshvili, Project Manager @ Stormotion

Create an MVP

Starting with an MVP that focuses on core functionalities can minimize initial costs. Launch the MVP to gather user feedback, which can guide further health insurance application development and feature enhancement based on actual user needs.

With health insurance app development, users can access a detailed history of their claims (image by Jack R.)

Use Third-Party Resources

Leverage existing platforms and APIs for functionalities instead of developing everything from scratch. This approach can save both time and money, allowing you to focus resources on unique features that differentiate your app.

To sum up, understanding these costs and strategies will empower you to make informed decisions throughout the development process, ensuring a successful health insurance app launch. By planning effectively, you can create an app that not only meets user needs but also remains financially viable in a competitive marketplace.

🗂️ How Can Stormotion Help?

At Stormotion, we bring extensive experience in the healthcare industry, providing a range of medical app development services tailored to meet the unique needs of our clients. Whether you're looking to develop a health insurance application, mHealth apps for rehabilitation and prevention, or custom healthcare software, our team is equipped to deliver innovative solutions.

For example, our mobile app development company successfully collaborated on the Humanoo Kids project, where we developed an app that helps parents track their child's development and access expert health advice.

Our comprehensive solution included features for monitoring milestones and scheduling vaccinations, all while integrating seamlessly with Humanoo’s insurance services. This approach not only enhances user experience but also aligns with business objectives by promoting overall well-being.

Humanoo Kids app (image by Stormotion)

Another notable project was with Caspar Health, where we focused on modernizing their mobile app’s user interface and adding vital rehabilitation tracking features. Caspar’s app also integrates with life insurance providers, ensuring a smooth experience for users managing their health benefits.

By enhancing the app’s accessibility and ensuring compliance with international standards, our development team significantly improved patient engagement and therapy outcomes.

Caspar Health app (image by Stormotion)

Our expertise in creating user-friendly interfaces, ensuring regulatory compliance, and implementing robust back-end solutions guarantees that your health insurance software development will effectively meet the evolving needs of both providers and users

💡 Takeaways

To sum up, developing a successful health insurance mobile app requires careful planning, understanding of market trends, and strategic execution. Here are the key points to consider:

- Essential app features include user profiles, claims management, payment tracking, real-time updates, secure data sharing, and AI-driven tools for early diagnosis, all designed to enhance user experience and operational efficiency.

- Building an app involves several stages, including thorough research, feature planning, UI/UX design, coding, compliance checks, rigorous testing, and post-launch maintenance to keep the app functional and up-to-date.

- The health insurance app development budget is affected by factors like software licensing, infrastructure, development complexity, and third-party integrations. Regular maintenance and updates are also essential for long-term success.

- To reduce expenses, consider outsourcing development, validating ideas with market feedback, creating an MV), and leveraging third-party APIs for certain functionalities.

By addressing these elements, your health insurance app will not only meet user needs but also thrive in a competitive and growing marketplace.

Do you have questions about our development process? Let us help you navigate the complexities of health insurance mobile application development to deliver exceptional value to your customers.

![Stormotion client Max Scheidlock, Product Manager from [object Object]](/static/33294af91c38256bcd5a780ddc41861a/b0e74/max.png)